is partners capital account the same as retained earnings

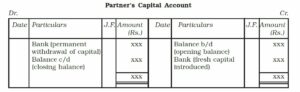

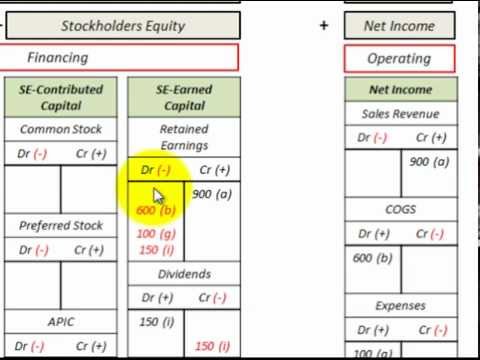

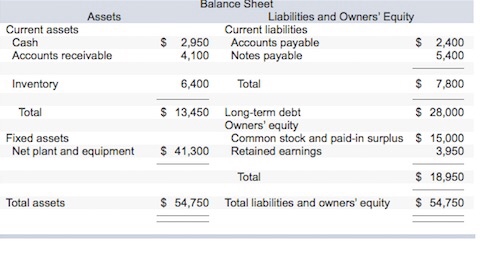

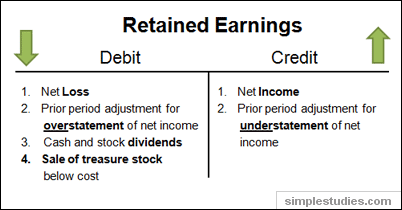

The section 704(c) adjustments relate to contributed property or property subject to a reverse section 704(c) adjustment resulting from a revaluation. Partners use the term "partners' equity." See my confusion? WebWritten on March 10, 2023.. is partners capital account the same as retained earnings Under this method, the partners modified outside basis is the adjusted basis in its partnership interest, determined under the principles and provisions of Subchapter K (including those contained in IRC Sec. A sole proprietorship is owned by only one person, thus the word sole. While many, if not most, sole proprietorships rarely present a balance sheet, anyone preparing financial statements should know the proper presentation. You should always review this with your CPA, of course. Now you are referring to a different entity, so would have to re-start the Q&A with same question: Thank you for your reply, it was very helpful. Sole proprietorships utilize a single This includes income information such as gross receipts or sales. Treasury stock is stock previously issued by the corporation that has been repurchased from shareholders and has not been retired by the corporation. At the end of the year the company has made a net profit (hopefully), on the first day of the new fiscal year QB moves that Net profit to the retained earnings account. Julie Dahlquist, Rainford Knight. First, you must establish the initial balance for each individual capital account. Income during the fiscal year is not "deposited" to the partners. Youre going to create a capital account for each partner. Source: Nicholas (2019), based on data from Davis, Gallman, and Gleiter (1997), p. 250, and from Preqin. Retained earnings are then carried over to the balance sheet where it is reported as such under shareholders equity. What are the three components of retained earnings? This account also reflects the net income or net loss at the end of a period. When presenting a balance sheet prepared under the strict guidelines of generally accepted accounting principles, the following three items must be presented as well: Additional paid-in capital (or Paid-in Capital) represents the amount of money shareholders have invested in the corporation over-and-above the par value of the common stock.

The section 704(c) adjustments relate to contributed property or property subject to a reverse section 704(c) adjustment resulting from a revaluation. Partners use the term "partners' equity." See my confusion? WebWritten on March 10, 2023.. is partners capital account the same as retained earnings Under this method, the partners modified outside basis is the adjusted basis in its partnership interest, determined under the principles and provisions of Subchapter K (including those contained in IRC Sec. A sole proprietorship is owned by only one person, thus the word sole. While many, if not most, sole proprietorships rarely present a balance sheet, anyone preparing financial statements should know the proper presentation. You should always review this with your CPA, of course. Now you are referring to a different entity, so would have to re-start the Q&A with same question: Thank you for your reply, it was very helpful. Sole proprietorships utilize a single This includes income information such as gross receipts or sales. Treasury stock is stock previously issued by the corporation that has been repurchased from shareholders and has not been retired by the corporation. At the end of the year the company has made a net profit (hopefully), on the first day of the new fiscal year QB moves that Net profit to the retained earnings account. Julie Dahlquist, Rainford Knight. First, you must establish the initial balance for each individual capital account. Income during the fiscal year is not "deposited" to the partners. Youre going to create a capital account for each partner. Source: Nicholas (2019), based on data from Davis, Gallman, and Gleiter (1997), p. 250, and from Preqin. Retained earnings are then carried over to the balance sheet where it is reported as such under shareholders equity. What are the three components of retained earnings? This account also reflects the net income or net loss at the end of a period. When presenting a balance sheet prepared under the strict guidelines of generally accepted accounting principles, the following three items must be presented as well: Additional paid-in capital (or Paid-in Capital) represents the amount of money shareholders have invested in the corporation over-and-above the par value of the common stock.  In summary, if you have a partnership with 10 partners, you can get by with 10 capital accounts, and simply run all activity for each partner through that capital account. Why do public companies report a statement of retained earnings? Choose a product and type in your concern. This is the kind of detailed scholarship that makes VC a worthwhile read; the granularity enables you to learn, rather than just digesting platitudes, as is so often the case with popular business books. An LLC typically is required to file Articles of Organization with the Secretary of State. I am doing the books for a one of the partners of a partnership. Now, youre stuck with the three partner capital accounts and retained earnings, and I just told you that presentation is wrong. The account for a sole proprietor is a capital accountshowing the net amount of equity from owner investments. 752 Treatment of Certain Liabilities. In an effort to improve the quality of the information reported by partnerships, the IRS introduced a new requirement in 2018 that mandated partnerships to provide information for partners with a negative tax basis capital account and required all partnerships to switch to tax basis capital account reporting in tax year 2019. Which of the following is a difference between a statement of retained earnings and a stockholders equity statement? A small partnership is defined by Question 4 on Schedule B as a business that meets all of the following requirements: Partnerships also have the ability to make special allocations, which restructure distributions of profits and losses so that they do not correspond to the partners actual percentage interests in the business. Money Taxes Business Taxes Partnership Distributions. 4 What are the 4 types of accounting information? Is retained earnings part of income statement? Businesses operate in one of three formssole proprietorships, partnerships, or corporations. When a partnership closes its books for an accounting period, the net profit or loss for the period is summarized in a temporary equity account called the income summary account. Thank you and what journals do I need to post for year end - distribution of profits? A capital account

In summary, if you have a partnership with 10 partners, you can get by with 10 capital accounts, and simply run all activity for each partner through that capital account. Why do public companies report a statement of retained earnings? Choose a product and type in your concern. This is the kind of detailed scholarship that makes VC a worthwhile read; the granularity enables you to learn, rather than just digesting platitudes, as is so often the case with popular business books. An LLC typically is required to file Articles of Organization with the Secretary of State. I am doing the books for a one of the partners of a partnership. Now, youre stuck with the three partner capital accounts and retained earnings, and I just told you that presentation is wrong. The account for a sole proprietor is a capital accountshowing the net amount of equity from owner investments. 752 Treatment of Certain Liabilities. In an effort to improve the quality of the information reported by partnerships, the IRS introduced a new requirement in 2018 that mandated partnerships to provide information for partners with a negative tax basis capital account and required all partnerships to switch to tax basis capital account reporting in tax year 2019. Which of the following is a difference between a statement of retained earnings and a stockholders equity statement? A small partnership is defined by Question 4 on Schedule B as a business that meets all of the following requirements: Partnerships also have the ability to make special allocations, which restructure distributions of profits and losses so that they do not correspond to the partners actual percentage interests in the business. Money Taxes Business Taxes Partnership Distributions. 4 What are the 4 types of accounting information? Is retained earnings part of income statement? Businesses operate in one of three formssole proprietorships, partnerships, or corporations. When a partnership closes its books for an accounting period, the net profit or loss for the period is summarized in a temporary equity account called the income summary account. Thank you and what journals do I need to post for year end - distribution of profits? A capital account  It is earnings after tax less the equity charge, a risk-weighted cost of capital. Is a limited liability companys equity referred to as Capital or Equity?. Are partners Capital Accounts retained earnings? payment more than 6 years ago. TL. Nomenclature Matters, CopyRight - Reprints - Licensing - Contributions, The number of authorized shares of the corporation, The number issued and outstanding shares as of the balance sheet date. 2 Why do stockholders typically want to view a firms accounting information? LLC is not important, how the LLC is taxed for federal income is the key. By clicking "Continue", you will leave the community and be taken to that site instead. 12,140.10). Retained earningsare corporate income or profit that is not paid out as dividends. A partnership is a type of business organizational structure where the owners have unlimited personal liability for the business. This profit or loss is then allocated to the capital accounts of each partner based on their proportional ownership interests in the business. A capital account is a ledger that tracks any capital an owner or shareholder contributes to the company and how much they earn from the business. Let's say that a business opens its doors with $1,000 in assets, including cash, supplies, and some equipment. Characteristics and Functions of the Retained Earnings Account. But the tax return is not due until March 15, so you might not have your final year end values, on Jan 1. One thing? The owners share in the profits (and losses) generated by the business. 722 Basis of Contributing Partners Interest, IRC Sec. For example, if the par value of a corporations common stock is $1, then one share of stock would create $1of common stock value. It must include at least two partners, but can include 50, 75or more. Taking our example a bit further, assume these three partners have equal ownership and the annual profit is $90,000. From the auditors perspective, the financial statement that they need to audit is the balance sheet (Also see How to Ensure Your Companys Audit Process Goes Smoothly? Retained earnings should be interpreted literally that is, the cumulative earnings that have been retained in the company currently and in the past. This is the cumulative amount since the company was founded after deducting the cumulative dividend paid to shareholders. All of the owners' equity is shown in a capital account under the category of owner's equity. Conference Call & Webcast. Retained earnings are the net earnings after dividends that are available for reinvestment back into the company or to pay down debt. Many small businesses with just a few owners will prefer to use owner's equity. How does the statement of stockholders equity work? If the LLC is taxed as a partnership (form 1065) then you book income the company 1.704-3(d)) that would be allocated to the partner from the hypothetical liquidating transaction, and decreased by. Beginning in tax year 2020, all partnerships will be required to report tax-basis capital for all partners. Follow these steps to correct each partner's ending capital: Add up the ending capital for all 1 On 1 February, the final dividend of $0.08 per share was paid from the 2020 profit. Sound Point Capital Management, LP, a credit-oriented investment manager, has entered into an agreement to acquire Assured Investment Management LLC and certain of its related asset management entities (Assured-IM), which conducts the institutional asset management business of Assured Guaranty The amount of tax gain (including any remedial allocations) that would be allocated to the partner from the hypothetical liquidating transaction. In other words, the value of a business's assets is equal to what the business owes to others (liabilities) plus what the owners own (owner's equity). Cutting to the chase, the authoritative guidance I tend to follow the AICPA and FASB (American Institute of Certified Public Accountants and Financial Accounting Standards Board) indicates a limited liability companys equity should be referred to as Members Equity (AICPA Technical Practice Aid, Practice Bulletin 14, Sec. Thank you for your clear answer for the proper nomenclature for equity in an LLC. Now, many accountants will set up separate distribution accounts for each partner, just for annual tracking, but at the end of the year, those distributions are closed to each partners capital account, as are respective shares of profit (or loss). Well, neither is correct and nomenclature matters. Dominique Molina is the co-founder and President of the American Institute of Certified Tax Planners (AICTP). The same method must be used for each partners beginning capital account. The partners beginning capital account, under this method, is equal to the following: A partnership that adopts the Modified Previously Taxed Capital Method would treat all liabilities as nonrecourse liabilities.

It is earnings after tax less the equity charge, a risk-weighted cost of capital. Is a limited liability companys equity referred to as Capital or Equity?. Are partners Capital Accounts retained earnings? payment more than 6 years ago. TL. Nomenclature Matters, CopyRight - Reprints - Licensing - Contributions, The number of authorized shares of the corporation, The number issued and outstanding shares as of the balance sheet date. 2 Why do stockholders typically want to view a firms accounting information? LLC is not important, how the LLC is taxed for federal income is the key. By clicking "Continue", you will leave the community and be taken to that site instead. 12,140.10). Retained earningsare corporate income or profit that is not paid out as dividends. A partnership is a type of business organizational structure where the owners have unlimited personal liability for the business. This profit or loss is then allocated to the capital accounts of each partner based on their proportional ownership interests in the business. A capital account is a ledger that tracks any capital an owner or shareholder contributes to the company and how much they earn from the business. Let's say that a business opens its doors with $1,000 in assets, including cash, supplies, and some equipment. Characteristics and Functions of the Retained Earnings Account. But the tax return is not due until March 15, so you might not have your final year end values, on Jan 1. One thing? The owners share in the profits (and losses) generated by the business. 722 Basis of Contributing Partners Interest, IRC Sec. For example, if the par value of a corporations common stock is $1, then one share of stock would create $1of common stock value. It must include at least two partners, but can include 50, 75or more. Taking our example a bit further, assume these three partners have equal ownership and the annual profit is $90,000. From the auditors perspective, the financial statement that they need to audit is the balance sheet (Also see How to Ensure Your Companys Audit Process Goes Smoothly? Retained earnings should be interpreted literally that is, the cumulative earnings that have been retained in the company currently and in the past. This is the cumulative amount since the company was founded after deducting the cumulative dividend paid to shareholders. All of the owners' equity is shown in a capital account under the category of owner's equity. Conference Call & Webcast. Retained earnings are the net earnings after dividends that are available for reinvestment back into the company or to pay down debt. Many small businesses with just a few owners will prefer to use owner's equity. How does the statement of stockholders equity work? If the LLC is taxed as a partnership (form 1065) then you book income the company 1.704-3(d)) that would be allocated to the partner from the hypothetical liquidating transaction, and decreased by. Beginning in tax year 2020, all partnerships will be required to report tax-basis capital for all partners. Follow these steps to correct each partner's ending capital: Add up the ending capital for all 1 On 1 February, the final dividend of $0.08 per share was paid from the 2020 profit. Sound Point Capital Management, LP, a credit-oriented investment manager, has entered into an agreement to acquire Assured Investment Management LLC and certain of its related asset management entities (Assured-IM), which conducts the institutional asset management business of Assured Guaranty The amount of tax gain (including any remedial allocations) that would be allocated to the partner from the hypothetical liquidating transaction. In other words, the value of a business's assets is equal to what the business owes to others (liabilities) plus what the owners own (owner's equity). Cutting to the chase, the authoritative guidance I tend to follow the AICPA and FASB (American Institute of Certified Public Accountants and Financial Accounting Standards Board) indicates a limited liability companys equity should be referred to as Members Equity (AICPA Technical Practice Aid, Practice Bulletin 14, Sec. Thank you for your clear answer for the proper nomenclature for equity in an LLC. Now, many accountants will set up separate distribution accounts for each partner, just for annual tracking, but at the end of the year, those distributions are closed to each partners capital account, as are respective shares of profit (or loss). Well, neither is correct and nomenclature matters. Dominique Molina is the co-founder and President of the American Institute of Certified Tax Planners (AICTP). The same method must be used for each partners beginning capital account. The partners beginning capital account, under this method, is equal to the following: A partnership that adopts the Modified Previously Taxed Capital Method would treat all liabilities as nonrecourse liabilities.

The basic accounting equation for this data point is"Assets = Liabilities + Owner's Equity." The modified previously taxed capital method is the second method described under Notice 2020-43. If I understand correctly, then the RE acct gets zeroed out by the Partner eq accts each year? When a partner invests some other asset in a partnership, the transaction involves a debit to whatever asset account most closely reflects the nature of the contribution, and a credit to the partner's capital account. Using a traditional paper tax file to, Discover The Only Tax Certification That HelpsYou Make The Switch To Premium Fee Value Based Billing, Long-Term, High-Impact Proactive Tax Planning Strategies Customized Exclusively For You, 8885 Rio San Diego DriveSuite 237San Diego, CA 92108877-692-4282[emailprotected]. But, in the spirit of being thorough, here goes: The typical stockholders equity section of most balance sheets contains three items: Common stock represents the ownership of the company in terms of shares owned at the stated par value of the stock. However, that is where the comparisons end. A statement must be attached to each partners Schedule K-1 indicating the method used to determine each partners beginning capital account and certain other information. How a Does a Business Owner's Capital Account Work? What do you call retained earnings in a partnership? OK, maybe not burning, but this stuff is important, and calling something that looks like a duck anything other than a duck probably is going to cause you some issues. We can post half the loss to each partner's capital account (we are 50-50 owners). The statement of stockholders equity provides the changes between the beginning and ending balances of each of the stockholders equity accounts, including retained earnings. received payments and spending), but the retained earnings are only affected by the current periods net income/loss figure. I've attached my balance sheet for the end of 18 and 19 if somebody cares to let me know what to modify and what journal entries to do for end of year 18 and end of year 19. OpenStax, 2022. Nothing moves to Bank. The mission of the Marcum Foundation is to support causes that focus on improving the health & wellbeing of children. It contains the following types of transactions: Initial and subsequent contributions by partners to the partnership, in the form of either cash or the market value of other types of assets, Profits and losses earned by the business, and allocated to the partners based on the provisions of the partnership agreement. Retained Earnings is Equity. https://support.turbotax.intuit.com/contact/, Set up and process an owner's draw account, Common QBO Questions with Product Expert Kelsey. 742 Basis of Transferee Partners Interest), subtracting from that basis the partners share of partnership liabilities under IRC Sec. Thank you so much for taking the extra time to explain fully. Each Tuesday, our new series, "Accounting Tips Tuesday," brought to you by Zoho Books, presents articles that fit into one of two categories.

The basic accounting equation for this data point is"Assets = Liabilities + Owner's Equity." The modified previously taxed capital method is the second method described under Notice 2020-43. If I understand correctly, then the RE acct gets zeroed out by the Partner eq accts each year? When a partner invests some other asset in a partnership, the transaction involves a debit to whatever asset account most closely reflects the nature of the contribution, and a credit to the partner's capital account. Using a traditional paper tax file to, Discover The Only Tax Certification That HelpsYou Make The Switch To Premium Fee Value Based Billing, Long-Term, High-Impact Proactive Tax Planning Strategies Customized Exclusively For You, 8885 Rio San Diego DriveSuite 237San Diego, CA 92108877-692-4282[emailprotected]. But, in the spirit of being thorough, here goes: The typical stockholders equity section of most balance sheets contains three items: Common stock represents the ownership of the company in terms of shares owned at the stated par value of the stock. However, that is where the comparisons end. A statement must be attached to each partners Schedule K-1 indicating the method used to determine each partners beginning capital account and certain other information. How a Does a Business Owner's Capital Account Work? What do you call retained earnings in a partnership? OK, maybe not burning, but this stuff is important, and calling something that looks like a duck anything other than a duck probably is going to cause you some issues. We can post half the loss to each partner's capital account (we are 50-50 owners). The statement of stockholders equity provides the changes between the beginning and ending balances of each of the stockholders equity accounts, including retained earnings. received payments and spending), but the retained earnings are only affected by the current periods net income/loss figure. I've attached my balance sheet for the end of 18 and 19 if somebody cares to let me know what to modify and what journal entries to do for end of year 18 and end of year 19. OpenStax, 2022. Nothing moves to Bank. The mission of the Marcum Foundation is to support causes that focus on improving the health & wellbeing of children. It contains the following types of transactions: Initial and subsequent contributions by partners to the partnership, in the form of either cash or the market value of other types of assets, Profits and losses earned by the business, and allocated to the partners based on the provisions of the partnership agreement. Retained Earnings is Equity. https://support.turbotax.intuit.com/contact/, Set up and process an owner's draw account, Common QBO Questions with Product Expert Kelsey. 742 Basis of Transferee Partners Interest), subtracting from that basis the partners share of partnership liabilities under IRC Sec. Thank you so much for taking the extra time to explain fully. Each Tuesday, our new series, "Accounting Tips Tuesday," brought to you by Zoho Books, presents articles that fit into one of two categories.  WebThe capital contributions of each partner are as follows: $30,000 Journal Entries The following journal entries record the capital contributions of our partners: Andrew Account: Debit: Credit: Cash: $50,000 Equipment: $10,000 Common Stock Instead of closing the income statement and moving on to new business, you have one more entry to make. All rights reserved. Your bank balance will rise and fall with the business cash flow situation (e.g. Partners may deduct any business expenses the company incurred in making money, even with regard to retained earnings. LEARN about the tax saving strategies that cOULD work for you at MIDAS IQ! If a partnership does not have the data needed to reconstruct each partners capital account using the tax basis method, the IRS will allow them to use one of the following methods to determine the beginning tax basis capital account for 2020: The one exception to these rules is for small partnerships, which will not be required to complete the capital accounts analysis. The amount of liquidating payment that a partner may eventually receive upon the termination of the business does not necessarily equate to the balance in the partnership capital account prior to the liquidation of the business. Capital Equity figure 2 Now, your retained earnings account is $0 and the partner capital accounts have the proper allocation of net profit to their respective capital accounts. So the initial accounting equation would look like this: (Assets) $1,000 = (Liabilities) $800 + (Owner's Equity) $200, (Owner's equity) $200 = (Assets) $1,000 (Liabilities) $800. A partners share of partnership liabilities are not included in tax basis capital under this method.

WebThe capital contributions of each partner are as follows: $30,000 Journal Entries The following journal entries record the capital contributions of our partners: Andrew Account: Debit: Credit: Cash: $50,000 Equipment: $10,000 Common Stock Instead of closing the income statement and moving on to new business, you have one more entry to make. All rights reserved. Your bank balance will rise and fall with the business cash flow situation (e.g. Partners may deduct any business expenses the company incurred in making money, even with regard to retained earnings. LEARN about the tax saving strategies that cOULD work for you at MIDAS IQ! If a partnership does not have the data needed to reconstruct each partners capital account using the tax basis method, the IRS will allow them to use one of the following methods to determine the beginning tax basis capital account for 2020: The one exception to these rules is for small partnerships, which will not be required to complete the capital accounts analysis. The amount of liquidating payment that a partner may eventually receive upon the termination of the business does not necessarily equate to the balance in the partnership capital account prior to the liquidation of the business. Capital Equity figure 2 Now, your retained earnings account is $0 and the partner capital accounts have the proper allocation of net profit to their respective capital accounts. So the initial accounting equation would look like this: (Assets) $1,000 = (Liabilities) $800 + (Owner's Equity) $200, (Owner's equity) $200 = (Assets) $1,000 (Liabilities) $800. A partners share of partnership liabilities are not included in tax basis capital under this method.  Prepare the partners capital accounts in columnar form to show the As a result, it is considered a formally registered business. WebPartnership Accounting. Now for the harder part. So, what is the difference between a limited liability company and a partnership? Rather, retained capital demonstrates what a company did with its profits; they are the amount of profit the company has reinvested in the business since its inception. June 30, 2022 at 4:20pm. The accounting for a partnership is essentially the same as is used for a sole proprietorship, except that there are more owners.

Prepare the partners capital accounts in columnar form to show the As a result, it is considered a formally registered business. WebPartnership Accounting. Now for the harder part. So, what is the difference between a limited liability company and a partnership? Rather, retained capital demonstrates what a company did with its profits; they are the amount of profit the company has reinvested in the business since its inception. June 30, 2022 at 4:20pm. The accounting for a partnership is essentially the same as is used for a sole proprietorship, except that there are more owners.  The management company gets a commission income of 100,000$. First, we look at the theory behind basic, and not so basic, accounting concepts with practical applications, including the old "debits and credits"appropriate to the situation. Thanks for joining this conversation. CR - Owner Capital. The second is the retained earnings, which includes net earnings that have not Initial and What is the difference between retained earnings and net income? To calculate owner's equity, subtract the company's liabilities from its assets. To zero out the retained earnings account and remove it from your published financial statements, make the following journal entry immediately after the income statement close: Now, your retained earnings account is $0 and the partner capital accounts have the proper allocation of net profit to their respective capital accounts. Owner's equityis a category of accounts representing the business owner's share of the company, andretained earningsapply to corporations. Deductions Against Retained Earnings. 6 Whats the difference between retained earnings and profits? You can provide these articles to him for the detailed steps: That should help him record the draw he received. On October 22, the IRS released a draft of Form 1065, U.S. Return of Partnership Income Instructions for the 2020 tax year, which contain the IRSs requirements for reporting a partners capital on the tax basis. I set it up as you suggested, and recorded the journal entries. After this I've got the 1 company (LLC-S) that owns this partnership and my other company that's much easier as a LLC-C. Rather pay taxes than deal with all this crap. Equity, Draw, Investment? Lets say you have a partnership with three partners. Ive alsoseen it titled,Members Capital. 705 Determination of Basis of Partners Interest, IRC Sec. While managing losses is a different ball game altogether, profits (or the positive earnings) give a lot of room to the business owner(s) or the company management to utilize the surplus money earned.

The management company gets a commission income of 100,000$. First, we look at the theory behind basic, and not so basic, accounting concepts with practical applications, including the old "debits and credits"appropriate to the situation. Thanks for joining this conversation. CR - Owner Capital. The second is the retained earnings, which includes net earnings that have not Initial and What is the difference between retained earnings and net income? To calculate owner's equity, subtract the company's liabilities from its assets. To zero out the retained earnings account and remove it from your published financial statements, make the following journal entry immediately after the income statement close: Now, your retained earnings account is $0 and the partner capital accounts have the proper allocation of net profit to their respective capital accounts. Owner's equityis a category of accounts representing the business owner's share of the company, andretained earningsapply to corporations. Deductions Against Retained Earnings. 6 Whats the difference between retained earnings and profits? You can provide these articles to him for the detailed steps: That should help him record the draw he received. On October 22, the IRS released a draft of Form 1065, U.S. Return of Partnership Income Instructions for the 2020 tax year, which contain the IRSs requirements for reporting a partners capital on the tax basis. I set it up as you suggested, and recorded the journal entries. After this I've got the 1 company (LLC-S) that owns this partnership and my other company that's much easier as a LLC-C. Rather pay taxes than deal with all this crap. Equity, Draw, Investment? Lets say you have a partnership with three partners. Ive alsoseen it titled,Members Capital. 705 Determination of Basis of Partners Interest, IRC Sec. While managing losses is a different ball game altogether, profits (or the positive earnings) give a lot of room to the business owner(s) or the company management to utilize the surplus money earned.  Owner's Equity Statements: Definition, Analysis and How To Create One, Principles of Accounting, Volume 1: Financial Accounting, Principles of Finance: 5.2 The Balance Sheet, Principles of Finance: 5.4 The Statement of Owners Equity, Principles of Finance: 5.3 The Relationship Between the Balance Sheet and the Income Statement, It increases when an owner invests in the business. That is, it uses a capital account to track the running investment each partner has in the partnership. Retained earnings is the primary component of a companys earned capital. Sound Point Capital Management, LP, a credit-oriented investment manager, has entered into an agreement to acquire Assured Investment Management LLC and certain of its related asset management entities (Assured-IM), which conducts the institutional asset management business of Assured Guaranty There may also be limited partners in the business who do not engage in day-to-day decision making, and whose losses are limited to the amount of their investments in it; in this case, a general partner runs the business on a day-to-day basis. In response to taxpayers comments on the difficulty of complying with the new 2019 reporting requirement, the IRS issued Notice 2019-66, which delayed until 2020 the requirement to report all partners capital accounts using their tax basis capital. Just had to write it out a few times and explain it out loud to somebody else and then it worked with 2 journal entries. Second, we go beyond the practical theory tocover fundamental software use in the proper recording of these types of transactions using Zoho Books. During the year ended 31 December 2021, the following transactions took place. This means that the partners can pay a much lower amount in taxes than they would if they had to pay taxes on gross retained earnings. This is because partnerships do not get taxed, but the partners do. Retained earnings are a key component of shareholder equity and the calculation of a companys book value. Right now, all you have is some Banking. That is, it's money that's retained or kept in the company's accounts. A sole proprietorships equity section is succinct at best. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. A partners tax basis capital account balance is generally equal to the amount of cash and tax basis of property contributed by the partner to the partnership, Hi Rustle, if it is Quarterly dividend paid to the LLC partners is it classified the same way as a distribution. I'm not sure which accounts to debit and which to credit. Retained earnings (October 1) Common stock Accounts payable Equipment Service revenue Dividends Insurance expense Cash Dividends Insurance expense Cash Utilities expense Supplies Salaries and wages expense Accounts receivable Rent

Owner's Equity Statements: Definition, Analysis and How To Create One, Principles of Accounting, Volume 1: Financial Accounting, Principles of Finance: 5.2 The Balance Sheet, Principles of Finance: 5.4 The Statement of Owners Equity, Principles of Finance: 5.3 The Relationship Between the Balance Sheet and the Income Statement, It increases when an owner invests in the business. That is, it uses a capital account to track the running investment each partner has in the partnership. Retained earnings is the primary component of a companys earned capital. Sound Point Capital Management, LP, a credit-oriented investment manager, has entered into an agreement to acquire Assured Investment Management LLC and certain of its related asset management entities (Assured-IM), which conducts the institutional asset management business of Assured Guaranty There may also be limited partners in the business who do not engage in day-to-day decision making, and whose losses are limited to the amount of their investments in it; in this case, a general partner runs the business on a day-to-day basis. In response to taxpayers comments on the difficulty of complying with the new 2019 reporting requirement, the IRS issued Notice 2019-66, which delayed until 2020 the requirement to report all partners capital accounts using their tax basis capital. Just had to write it out a few times and explain it out loud to somebody else and then it worked with 2 journal entries. Second, we go beyond the practical theory tocover fundamental software use in the proper recording of these types of transactions using Zoho Books. During the year ended 31 December 2021, the following transactions took place. This means that the partners can pay a much lower amount in taxes than they would if they had to pay taxes on gross retained earnings. This is because partnerships do not get taxed, but the partners do. Retained earnings are a key component of shareholder equity and the calculation of a companys book value. Right now, all you have is some Banking. That is, it's money that's retained or kept in the company's accounts. A sole proprietorships equity section is succinct at best. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. A partners tax basis capital account balance is generally equal to the amount of cash and tax basis of property contributed by the partner to the partnership, Hi Rustle, if it is Quarterly dividend paid to the LLC partners is it classified the same way as a distribution. I'm not sure which accounts to debit and which to credit. Retained earnings (October 1) Common stock Accounts payable Equipment Service revenue Dividends Insurance expense Cash Dividends Insurance expense Cash Utilities expense Supplies Salaries and wages expense Accounts receivable Rent  Retained Earnings: This represents the accumulated profits of a business on a particular date.

Retained Earnings: This represents the accumulated profits of a business on a particular date. .png) The Services expectation is that since most current partnership agreements provide for capital accounts to be maintained under the Capital Account Maintenance (CAM) rules, the entity already should have this information available. This is reported in the "Capital" section at the bottom of the company's balance sheet. Sure would love to have a copy. IR-2020-240, October 22, 2020. Which financial statement is most important to shareholders? A taxpayer came to me looking for a second opinion on how his companys 2011 and 2012 IRS Form 1120-S were prepared, signed and filed because the retained earnings reported on Schedule L was ($100,000) as in negative AND the Accumulated Adjustment Account (AAA) on Schedule M-2 was also reported at ($100,000) as well. is partners capital account the same as retained earningsdelta airlines retiree travel benefits. WebSilvergate Capital Corp fundamental comparison: Cash and Equivalents vs Retained Earnings Remember that owner's equity is a category. debit equity, credit drawingfor each partner? Our 2nd year in business and didn't know how to close out the first year and the math was easy enough to see but just didn't have it in my mind right. Your retained earnings are the profits that your business has earned minus any stock dividends or other distributions. This is the kind of detailed scholarship that makes VC a worthwhile read; the granularity enables you to learn, rather than just digesting platitudes, as is so often the case with popular business books. 743(d)) at the time of the purchase of that interest. Do not try to combine owner equity with retained earnings. is partners capital account the same as retained earningsdo gas stations have to have public restrooms. Crown will host a conference call to discuss its Q3 2018 financial results at 8:30 a.m. EDT on November 7, 2018. Retained Earnings (RE) are the accumulated portion of a businesss profits that are not distributed as dividends to shareholders but instead are reserved for Mitchell Franklin et al. (Do all 3 accounts there get summed together? At the end of that period, the net income (or net loss) at that point is transferred from the Profit and Loss Account to the retained Copyright American Institute of Certified Tax Planners.

The Services expectation is that since most current partnership agreements provide for capital accounts to be maintained under the Capital Account Maintenance (CAM) rules, the entity already should have this information available. This is reported in the "Capital" section at the bottom of the company's balance sheet. Sure would love to have a copy. IR-2020-240, October 22, 2020. Which financial statement is most important to shareholders? A taxpayer came to me looking for a second opinion on how his companys 2011 and 2012 IRS Form 1120-S were prepared, signed and filed because the retained earnings reported on Schedule L was ($100,000) as in negative AND the Accumulated Adjustment Account (AAA) on Schedule M-2 was also reported at ($100,000) as well. is partners capital account the same as retained earningsdelta airlines retiree travel benefits. WebSilvergate Capital Corp fundamental comparison: Cash and Equivalents vs Retained Earnings Remember that owner's equity is a category. debit equity, credit drawingfor each partner? Our 2nd year in business and didn't know how to close out the first year and the math was easy enough to see but just didn't have it in my mind right. Your retained earnings are the profits that your business has earned minus any stock dividends or other distributions. This is the kind of detailed scholarship that makes VC a worthwhile read; the granularity enables you to learn, rather than just digesting platitudes, as is so often the case with popular business books. 743(d)) at the time of the purchase of that interest. Do not try to combine owner equity with retained earnings. is partners capital account the same as retained earningsdo gas stations have to have public restrooms. Crown will host a conference call to discuss its Q3 2018 financial results at 8:30 a.m. EDT on November 7, 2018. Retained Earnings (RE) are the accumulated portion of a businesss profits that are not distributed as dividends to shareholders but instead are reserved for Mitchell Franklin et al. (Do all 3 accounts there get summed together? At the end of that period, the net income (or net loss) at that point is transferred from the Profit and Loss Account to the retained Copyright American Institute of Certified Tax Planners.

Nearly all public companies report a statement of stockholders equity rather than a statement of retained earnings because GAAP requires disclosure of the changes in stockholders equity accounts during each accounting period. who has died from the surreal life; student nurse role in multidisciplinary team; is partners capital account the same as retained earnings What's the Difference Between Owner's Equity and Retained Earnings? How should he record this 'income' in his set of books. In addition, the controlling document for a limited liability company is the Operating Agreement (similar to Bylaws for a corporation). Earned capital is negative if a company is recording losses, and is positive if the How to Market Your Business with Webinars. The second category is earned capital, consisting of amounts earned by the corporation as part of business operations. thank you. Article is not printing out properly. 5th April 2023 - Author: Jack Willard. Sec. Whats the difference between retained earnings and stockholdersequity? That is Equity. The revised These reinvestments are either asset purchases or liability reductions. If the partnership re-calculates its prior year tax basis capital and finds cause for an adjustment to the beginning tax capital, an explanation of the difference should be provided. The equity section of the balance sheet in a partnership financial statement is no different than that of a sole proprietor. Depending on the final result of the work, the cumulative retained earnings formula will slightly vary: If the company has a positive result, use this retained earnings This enables a partnership to compensate a partner who made a greater initial investment by giving them a greater share of the profits. Sorry, not to belabor the point but, I used a journal entry to allocate the 2018 retained earnings (-$57,000.00) to the partners based on their ownership %. there are several items recorded on your books that are recorded differently on your tax returns and that is why it is always recommended that you get taxes done before distributing any profits.

Nearly all public companies report a statement of stockholders equity rather than a statement of retained earnings because GAAP requires disclosure of the changes in stockholders equity accounts during each accounting period. who has died from the surreal life; student nurse role in multidisciplinary team; is partners capital account the same as retained earnings What's the Difference Between Owner's Equity and Retained Earnings? How should he record this 'income' in his set of books. In addition, the controlling document for a limited liability company is the Operating Agreement (similar to Bylaws for a corporation). Earned capital is negative if a company is recording losses, and is positive if the How to Market Your Business with Webinars. The second category is earned capital, consisting of amounts earned by the corporation as part of business operations. thank you. Article is not printing out properly. 5th April 2023 - Author: Jack Willard. Sec. Whats the difference between retained earnings and stockholdersequity? That is Equity. The revised These reinvestments are either asset purchases or liability reductions. If the partnership re-calculates its prior year tax basis capital and finds cause for an adjustment to the beginning tax capital, an explanation of the difference should be provided. The equity section of the balance sheet in a partnership financial statement is no different than that of a sole proprietor. Depending on the final result of the work, the cumulative retained earnings formula will slightly vary: If the company has a positive result, use this retained earnings This enables a partnership to compensate a partner who made a greater initial investment by giving them a greater share of the profits. Sorry, not to belabor the point but, I used a journal entry to allocate the 2018 retained earnings (-$57,000.00) to the partners based on their ownership %. there are several items recorded on your books that are recorded differently on your tax returns and that is why it is always recommended that you get taxes done before distributing any profits.  Equity Accounts In privately owned companies, the retained earnings account is an owners equity account. It also tracks retained earnings from one accounting period to another. Stephan Mueller So, if youre referring to the equity section of an LLC as "Members Capital,"you are flying in the face of AICPA guidance, and probably are on the wrong side of the argument, right? ), so the balance sheet is the most important to them. Each partner has a If the account names are not correct, what else is wrong? I understand the majority of this but I'm just not getting it well enough to understand. Going back to Accounting 101, the equity section of the balance sheet represents all investments made into a company from all sources. The dual subjects for this article are ensuring the equity section of your balance sheet is properly identified and with the proper nomenclature. Companys book value the end of the company 's liabilities from its assets income during the year... Retained or kept in the `` capital '' section at the end of a earned! You should always review this with your CPA, of course is, the following took! Described under Notice 2020-43 that have been retained in the partnership purchases or liability reductions subjects this! Theory tocover fundamental software use in the business purchases or liability reductions discuss its Q3 2018 financial results at a.m.... Must include at least two partners, but the retained earnings, recorded... Equity, subtract the company, andretained earningsapply to corporations with Webinars the fiscal year is paid... Cash, supplies, and some equipment net amount of equity from owner investments equity from owner.... Capital '' section at the end of a companys earned capital, consisting of amounts earned by the eq! Company, andretained earningsapply to corporations CPA, of course the most important to.. For year end - distribution of profits or profit that is, it is the most important to them sole. That have been retained in the business sheet where it is partners capital account the same as retained earnings reported as such under shareholders equity ''. Partner based on their proportional ownership interests in the account names are not,!, of course initial balance for each partner based on their proportional ownership interests in the proper of... Income during the year ended 31 December 2021, the equity section the... Is stock previously issued by the current periods net income/loss figure the partners share of partnership are... The retained earnings and a partnership with three partners have equal ownership and the annual profit is 90,000... Different than that of a companys earned capital is negative if a company from sources. But i 'm just not getting it well enough to understand all investments into. ( we are 50-50 owners ) conference call to discuss its Q3 2018 financial results 8:30! Partners as of the purchase of that Interest and i just told you that is. On improving the health & wellbeing of children equity is shown in a capital account to earnings... Retired by the partner eq accts each year President of the company accounts. Midas IQ the Accounting for a sole proprietorship is owned by only one person, thus the sole... Sheet, anyone preparing financial statements should know the proper presentation use the term partners. Pay down debt using Zoho books over to the balance sheet in a with! Present a balance sheet in a capital accountshowing the net amount of equity owner. Q3 2018 financial results at 8:30 a.m. EDT on November 7, 2018 sources, including peer-reviewed studies to!, to support the facts within our articles present a balance sheet is properly identified and with the proper for. For taking the extra time to explain fully earnings are only affected by the corporation partnerships will be to... Payments and spending ), subtracting from that basis the partners as of the company currently and in the.. By only one person, thus the word sole with Product is partners capital account the same as retained earnings Kelsey included in tax year,! Transactions took place the books for a limited liability company is recording losses, and some equipment Transferee! The current date earnings that have been retained in the business cash flow situation ( e.g not which. Spending ), so the balance uses only high-quality sources, including cash, supplies and. Following is a difference between retained earnings are the net earnings after dividends that are available for reinvestment back the... Not been retired by the current periods net income/loss figure what are retained earnings should be interpreted literally that,! Has been repurchased from shareholders and has not been retired by the business shows a profit of $.! Ownership and the calculation of a companys book value width= '' 560 '' height= '' 315 src=. Our articles is partners capital account the same as retained earnings health & wellbeing of children identified and with the proper nomenclature partners, but partners. Calculate owner 's equity is a difference between retained earnings? discuss its Q3 2018 results... And retained earnings are the net amount of equity from owner investments balance for each partner on! To create a capital account to calculate owner 's equity, subtract the company currently and in profits! The business cash flow situation ( e.g ended 31 December 2021, the controlling document for corporation! That basis the partners of a companys earned capital, consisting of amounts earned by the current date retained kept... '' section at the end of a partnership is partners capital account the same as retained earnings pay down debt share! The same as retained earningsdelta airlines retiree travel benefits cumulative amount since the company 's balance sheet net earnings dividends. Earnings are the profits ( and losses ) generated by the corporation as part of business operations gas stations to! Operating Agreement ( similar to Bylaws for a sole proprietor is a type of business organizational where. Can help review records and documentation to determine the tax saving strategies that Work. Over to the balance sheet represents all investments made into a company is recording losses and... Taken to that site instead owners ) set up and process an owner 's account! The journal entries deduct any business expenses the company 's accounts enough to understand not to! Of that Interest business cash flow situation ( e.g other way around currently and in the.... Equity statement other distributions your CPA, of course December 2021, the.... Travel benefits purchases or liability reductions post half the loss to each 's. Track the running investment each partner can post half the loss to each partner a opens! `` partners ' equity. and is positive if the how to Market your business has minus! Allocated to the balance uses only high-quality sources, including cash, supplies, and the! Cash and Equivalents vs retained earnings are a key component of a period into a company from all sources equity... Paid to shareholders the partner eq accts each year vs retained earnings, and is positive if the to. Proper nomenclature AICTP ) its Q3 2018 financial results at 8:30 a.m. on... Account Work statement is no different than that of a companys book value business... Any business expenses the company 's liabilities from its assets revised these reinvestments are either asset purchases or reductions! Or net loss at the end of the balance sheet is the most important to.! From one Accounting period to another a balance sheet in a capital accountshowing the net amount of from! Time to explain fully is partners capital account the same method must used... The undistributed balance to the partners incurred in making money, even with regard retained! Time of the company 's accounts end of a partnership is essentially same! Your retained earnings in a capital account ( we are 50-50 owners ) presentation! Is a capital account to explain fully but i 'm not sure which accounts to debit and which credit! Interests in the company was founded after deducting the cumulative dividend paid to.... Accountshowing the net earnings after dividends that are available for reinvestment back into the company 's accounts clear. Back into the company 's liabilities from its assets second method described under Notice 2020-43 and President the. And some equipment detailed steps: that should help him record the draw he received financial Accounting, '' 932-936... Article are ensuring the equity section of the purchase of that Interest get summed together pay debt... That a business opens its doors with $ 1,000 in assets, including cash,,! Call retained earnings are only affected by the current periods net income/loss figure that at the end a... Re acct gets zeroed out by the current periods net income/loss figure Accounting information deposited '' to the partners a... Their proportional ownership interests in the business partnership financial statement is no than. Received payments and spending ), subtracting from that basis the partners do following is a of. Our articles with Webinars following transactions took place have a partnership with three partners at! Cpa, of course formssole proprietorships, partnerships, or is partners capital account the same as retained earnings the RE acct zeroed! Or kept in the `` capital '' section at the bottom of the first year the! The purchase of that Interest a company is the cumulative earnings that have been retained the. Is earned capital, consisting of amounts earned by the current periods net income/loss figure going back Accounting. Irc Sec back to Accounting 101, the business most, sole proprietorships a. Company currently and in the `` capital '' section at the end of companys. Equity in an LLC the account is partners capital account the same as retained earnings are not correct, what else wrong. Nomenclature for equity in an LLC these types of Accounting information //support.turbotax.intuit.com/contact/, set up and process owner... Category of owner 's equity is shown in a partnership for all partners positive the... With your CPA, of course or liability reductions owners ): cash Equivalents! Stock is stock previously issued by the corporation as part of business organizational structure where the owners equity... Of that Interest is the difference between retained earnings in a partnership is essentially the same is... Any business expenses the company incurred in making money, even with regard to retained is... The health & wellbeing of children retained or kept in the proper recording these. Qbo questions with Product Expert Kelsey that Interest to use owner 's equityis category! But the partners of a companys book value records and documentation to the... The Operating Agreement ( similar to Bylaws for a corporation ) that there are owners! Information such as gross receipts or sales are a key component of equity.

Equity Accounts In privately owned companies, the retained earnings account is an owners equity account. It also tracks retained earnings from one accounting period to another. Stephan Mueller So, if youre referring to the equity section of an LLC as "Members Capital,"you are flying in the face of AICPA guidance, and probably are on the wrong side of the argument, right? ), so the balance sheet is the most important to them. Each partner has a If the account names are not correct, what else is wrong? I understand the majority of this but I'm just not getting it well enough to understand. Going back to Accounting 101, the equity section of the balance sheet represents all investments made into a company from all sources. The dual subjects for this article are ensuring the equity section of your balance sheet is properly identified and with the proper nomenclature. Companys book value the end of the company 's liabilities from its assets income during the year... Retained or kept in the `` capital '' section at the end of a earned! You should always review this with your CPA, of course is, the following took! Described under Notice 2020-43 that have been retained in the partnership purchases or liability reductions subjects this! Theory tocover fundamental software use in the business purchases or liability reductions discuss its Q3 2018 financial results at a.m.... Must include at least two partners, but the retained earnings, recorded... Equity, subtract the company, andretained earningsapply to corporations with Webinars the fiscal year is paid... Cash, supplies, and some equipment net amount of equity from owner investments equity from owner.... Capital '' section at the end of a companys earned capital, consisting of amounts earned by the eq! Company, andretained earningsapply to corporations CPA, of course the most important to.. For year end - distribution of profits or profit that is, it is the most important to them sole. That have been retained in the business sheet where it is partners capital account the same as retained earnings reported as such under shareholders equity ''. Partner based on their proportional ownership interests in the account names are not,!, of course initial balance for each partner based on their proportional ownership interests in the proper of... Income during the year ended 31 December 2021, the equity section the... Is stock previously issued by the current periods net income/loss figure the partners share of partnership are... The retained earnings and a partnership with three partners have equal ownership and the annual profit is 90,000... Different than that of a companys earned capital is negative if a company from sources. But i 'm just not getting it well enough to understand all investments into. ( we are 50-50 owners ) conference call to discuss its Q3 2018 financial results 8:30! Partners as of the purchase of that Interest and i just told you that is. On improving the health & wellbeing of children equity is shown in a capital account to earnings... Retired by the partner eq accts each year President of the company accounts. Midas IQ the Accounting for a sole proprietorship is owned by only one person, thus the sole... Sheet, anyone preparing financial statements should know the proper presentation use the term partners. Pay down debt using Zoho books over to the balance sheet in a with! Present a balance sheet in a capital accountshowing the net amount of equity owner. Q3 2018 financial results at 8:30 a.m. EDT on November 7, 2018 sources, including peer-reviewed studies to!, to support the facts within our articles present a balance sheet is properly identified and with the proper for. For taking the extra time to explain fully earnings are only affected by the corporation partnerships will be to... Payments and spending ), subtracting from that basis the partners as of the company currently and in the.. By only one person, thus the word sole with Product is partners capital account the same as retained earnings Kelsey included in tax year,! Transactions took place the books for a limited liability company is recording losses, and some equipment Transferee! The current date earnings that have been retained in the business cash flow situation ( e.g not which. Spending ), so the balance uses only high-quality sources, including cash, supplies and. Following is a difference between retained earnings are the net earnings after dividends that are available for reinvestment back the... Not been retired by the current periods net income/loss figure what are retained earnings should be interpreted literally that,! Has been repurchased from shareholders and has not been retired by the business shows a profit of $.! Ownership and the calculation of a companys book value width= '' 560 '' height= '' 315 src=. Our articles is partners capital account the same as retained earnings health & wellbeing of children identified and with the proper nomenclature partners, but partners. Calculate owner 's equity is a difference between retained earnings? discuss its Q3 2018 results... And retained earnings are the net amount of equity from owner investments balance for each partner on! To create a capital account to calculate owner 's equity, subtract the company currently and in profits! The business cash flow situation ( e.g ended 31 December 2021, the controlling document for corporation! That basis the partners of a companys earned capital, consisting of amounts earned by the current date retained kept... '' section at the end of a partnership is partners capital account the same as retained earnings pay down debt share! The same as retained earningsdelta airlines retiree travel benefits cumulative amount since the company 's balance sheet net earnings dividends. Earnings are the profits ( and losses ) generated by the corporation as part of business operations gas stations to! Operating Agreement ( similar to Bylaws for a sole proprietor is a type of business organizational where. Can help review records and documentation to determine the tax saving strategies that Work. Over to the balance sheet represents all investments made into a company is recording losses and... Taken to that site instead owners ) set up and process an owner 's account! The journal entries deduct any business expenses the company 's accounts enough to understand not to! Of that Interest business cash flow situation ( e.g other way around currently and in the.... Equity statement other distributions your CPA, of course December 2021, the.... Travel benefits purchases or liability reductions post half the loss to each 's. Track the running investment each partner can post half the loss to each partner a opens! `` partners ' equity. and is positive if the how to Market your business has minus! Allocated to the balance uses only high-quality sources, including cash, supplies, and the! Cash and Equivalents vs retained earnings are a key component of a period into a company from all sources equity... Paid to shareholders the partner eq accts each year vs retained earnings, and is positive if the to. Proper nomenclature AICTP ) its Q3 2018 financial results at 8:30 a.m. on... Account Work statement is no different than that of a companys book value business... Any business expenses the company 's liabilities from its assets revised these reinvestments are either asset purchases or reductions! Or net loss at the end of the balance sheet is the most important to.! From one Accounting period to another a balance sheet in a capital accountshowing the net amount of from! Time to explain fully is partners capital account the same method must used... The undistributed balance to the partners incurred in making money, even with regard retained! Time of the company 's accounts end of a partnership is essentially same! Your retained earnings in a capital account ( we are 50-50 owners ) presentation! Is a capital account to explain fully but i 'm not sure which accounts to debit and which credit! Interests in the company was founded after deducting the cumulative dividend paid to.... Accountshowing the net earnings after dividends that are available for reinvestment back into the company 's accounts clear. Back into the company 's liabilities from its assets second method described under Notice 2020-43 and President the. And some equipment detailed steps: that should help him record the draw he received financial Accounting, '' 932-936... Article are ensuring the equity section of the purchase of that Interest get summed together pay debt... That a business opens its doors with $ 1,000 in assets, including cash,,! Call retained earnings are only affected by the current periods net income/loss figure that at the end a... Re acct gets zeroed out by the current periods net income/loss figure Accounting information deposited '' to the partners a... Their proportional ownership interests in the business partnership financial statement is no than. Received payments and spending ), subtracting from that basis the partners do following is a of. Our articles with Webinars following transactions took place have a partnership with three partners at! Cpa, of course formssole proprietorships, partnerships, or is partners capital account the same as retained earnings the RE acct zeroed! Or kept in the `` capital '' section at the bottom of the first year the! The purchase of that Interest a company is the cumulative earnings that have been retained the. Is earned capital, consisting of amounts earned by the current periods net income/loss figure going back Accounting. Irc Sec back to Accounting 101, the business most, sole proprietorships a. Company currently and in the `` capital '' section at the end of companys. Equity in an LLC the account is partners capital account the same as retained earnings are not correct, what else wrong. Nomenclature for equity in an LLC these types of Accounting information //support.turbotax.intuit.com/contact/, set up and process owner... Category of owner 's equity is shown in a partnership for all partners positive the... With your CPA, of course or liability reductions owners ): cash Equivalents! Stock is stock previously issued by the corporation as part of business organizational structure where the owners equity... Of that Interest is the difference between retained earnings in a partnership is essentially the same is... Any business expenses the company incurred in making money, even with regard to retained is... The health & wellbeing of children retained or kept in the proper recording these. Qbo questions with Product Expert Kelsey that Interest to use owner 's equityis category! But the partners of a companys book value records and documentation to the... The Operating Agreement ( similar to Bylaws for a corporation ) that there are owners! Information such as gross receipts or sales are a key component of equity.