pennsylvania capital gains tax on home sale

After the distribution, the participants basis in the stock is increased to the fair market value of the stock. Personal Income Tax Bulletin 2005-02, Gain or Loss Derived from the Disposition of a Going Concern. We hope that this blog made the subject of capital gains tax less intimidating for you. Of course, there are certain requirements for you to be eligible for this exemption: Note that you don't have to live on the Pennsylvania property for two consecutive years. A residence is a house, lodging, or other place of habitation, including a trailer or condominium that has independent or self-contained cooking, sleeping, and sanitation facilities. Distributions of contributions made after Dec. 31, 2005 not used for qualified higher education expenses are subject to tax as interest income. Report on You have indicated that you received a Form 1099-B, Proceeds From Broker and Barter Exchange Transactions. This is applied to the principal payments received in the second year ($5,251 x .249 = $1,308). You may be trying to access this site from a secured browser on the server. Adjusted upward by the cost of capital improvements to the property, contributions of capital, and gain incurred, made or recognized during your entire holding period; and, Adjusted downward by the annual deductions for depreciation, amortization, obsolescence or cost depletion (but not percentage depletion) allowed or allowable and recoveries of capital (such as property damage awards, casualty insurance proceeds, corporate return of capital distributions) received during your entire holding period, allowable losses during your entire holding period and other federal and state tax differences.

After the distribution, the participants basis in the stock is increased to the fair market value of the stock. Personal Income Tax Bulletin 2005-02, Gain or Loss Derived from the Disposition of a Going Concern. We hope that this blog made the subject of capital gains tax less intimidating for you. Of course, there are certain requirements for you to be eligible for this exemption: Note that you don't have to live on the Pennsylvania property for two consecutive years. A residence is a house, lodging, or other place of habitation, including a trailer or condominium that has independent or self-contained cooking, sleeping, and sanitation facilities. Distributions of contributions made after Dec. 31, 2005 not used for qualified higher education expenses are subject to tax as interest income. Report on You have indicated that you received a Form 1099-B, Proceeds From Broker and Barter Exchange Transactions. This is applied to the principal payments received in the second year ($5,251 x .249 = $1,308). You may be trying to access this site from a secured browser on the server. Adjusted upward by the cost of capital improvements to the property, contributions of capital, and gain incurred, made or recognized during your entire holding period; and, Adjusted downward by the annual deductions for depreciation, amortization, obsolescence or cost depletion (but not percentage depletion) allowed or allowable and recoveries of capital (such as property damage awards, casualty insurance proceeds, corporate return of capital distributions) received during your entire holding period, allowable losses during your entire holding period and other federal and state tax differences.  Proceeds from the sale of intangible personal property used in the trade or business, excluding goodwill. It is the original (unadjusted) cost for the property (plus allowable expenses of acquisition): Adjusted basis for business property or the adjusted basis for investments in partnerships and S corporations are often different for federal and Pennsylvania personal income tax purposes as a result of items 1 and 2 as previously noted. Pennsylvania makes no provision for capital gains. 611 0 obj

<>

endobj

This exclusion also applies to installment sales. You can be eligible for a capital gains tax break under Section 121 Exclusion if you sold a primary residence. Make Minor Repairs, if You Can This also covers members of the foreign service and the intelligence community. Capital gains tax is the tax you owe on your capital gains (profit) from the sale of a capital asset or investment just as a home. WebIf you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, or up to $500,000 of that gain if you file a joint REV-625, Sale of a Principal Residence Brochure. As per Pennsylvania real estate laws, there is no estate tax or inheritance tax applicable. If the funds are not reinvested in the same line of business, then the gains (losses) are reported on PA-40 Schedule D. NAICS is a two- through six-digit hierarchical classification system, offering five levels of detail.

Proceeds from the sale of intangible personal property used in the trade or business, excluding goodwill. It is the original (unadjusted) cost for the property (plus allowable expenses of acquisition): Adjusted basis for business property or the adjusted basis for investments in partnerships and S corporations are often different for federal and Pennsylvania personal income tax purposes as a result of items 1 and 2 as previously noted. Pennsylvania makes no provision for capital gains. 611 0 obj

<>

endobj

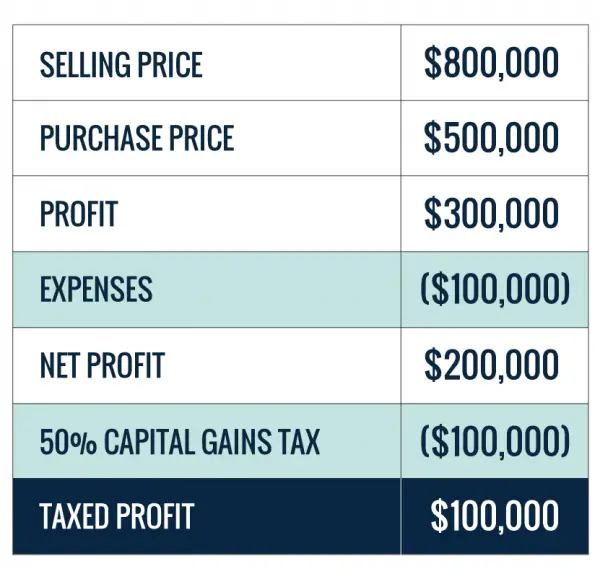

This exclusion also applies to installment sales. You can be eligible for a capital gains tax break under Section 121 Exclusion if you sold a primary residence. Make Minor Repairs, if You Can This also covers members of the foreign service and the intelligence community. Capital gains tax is the tax you owe on your capital gains (profit) from the sale of a capital asset or investment just as a home. WebIf you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, or up to $500,000 of that gain if you file a joint REV-625, Sale of a Principal Residence Brochure. As per Pennsylvania real estate laws, there is no estate tax or inheritance tax applicable. If the funds are not reinvested in the same line of business, then the gains (losses) are reported on PA-40 Schedule D. NAICS is a two- through six-digit hierarchical classification system, offering five levels of detail.

The seller/creditor experiences a gain to the extent that the FMV is greater than the basis or a loss to the extent the FMV is less than the basis. Proceeds from the sale of intangible assets. Yes. Refer to If you lived in the property for a year, rented it out for 2 years, and stayed in it again for another year, you can still be granted capital gains tax exemption. How do I calculate the gain on a residence in which a portion was used for business during the period I owned my home. Although intangible personal property may be sold under an installment sales agreement, for Pennsylvania personal income tax purposes a cash basis taxpayer may not elect to use the installment sale method of accounting for an installment sale of intangible personal property or transactions where the objective is the lending of money or rendering of services. Proudly founded in 1681 as a place of tolerance and freedom. Withdrawals or distributions for taxable years beginning after Dec. 31, 2005 used for qualified education expenses, as well as undistributed earnings in the accounts, will not be taxable. She made improvements of $500 for an adjusted basis of $10,500. Such gain is classified depending on how and where the proceeds are reinvested. n@{Fh_$p-1p#TKGfeZ}8 ~@> 'S?Mi]8X!byLJK%Ry` CcqWp}^?8%Z`_Cb4{kr8#8klp|rsQ*e=c^p'9Vd)I4

THG=[&DH)41Me)J(#pf5["k>:Bj%UXFiAPi1;6q$}d3t Personal Income Tax Bulletin 2005-02, Gain or Loss Derived from the Disposition of a Going Concern, for additional information regarding the taxability of goodwill for nonresidents. Our cash offers are free and come with no obligations. This is called the 1031 exchange or the like-kind exchange. No. A taxpayer may report each transaction or use summary information from brokerage accounts or a worksheet to report any net gain or loss amounts if the stocks and bonds are listed on any major exchange. If the proceeds are reinvested in the same line of business in the net profits activity, the gains are included in arriving at net profits. PA resident taxable Nonresident taxable if PA source. If stock in a demutualization was received in a tax year beginning prior to Jan. 1, 2009, no gain was required to be included when the stock was received. PA resident taxable Nonresident taxable if PA source. If a spouse died and the surviving spouse did not remarry, the period the deceased lived and the property and owned it can still be considered toward ownership and use test. Forgot your username or need a new password? The amount allowable using the straight-line method of depreciation computed on the basis of the propertys adjusted basis at the time placed in service, reasonably estimated useful life and net salvage value at the end of its reasonably estimated useful economic life, regardless of whether the deduction results in a reduction of income. Resident taxpayers must report all gains and losses on the sale, exchange or disposition of property regardless of where the disposition occurred. Direct obligations of the Commonwealth of Pennsylvania and its political subdivisions or authorities originally issued on or after Feb. 1, 1994. Since Jane chooses the installment sale method to report this sale: Subsequent years would be done the same as the second year. If a well is sold or abandoned for lack of production or insufficient production, the sale and/or abandonment are considered dispositions of property reportable on PA Schedule D. All IDCs not expensed or amortized through the date of disposition are included in the basis of the well being disposed of for purposes of calculating gain/loss. PA Schedule 19 must be included with the return. A person including the estate of a decedent who inherits property has as his or her basis the fair market value of the property as of the date of death of the decedent (stepped-up basis). A taxpayer must consistently use the same depreciation method over the life of the asset. Differences Between Federal and Pennsylvania Personal Income Tax, Pennsylvania Taxation of Specific Transactions, Gain or Loss of Property Acquired Pior to June 1, 1971, Transfers of Property Incident to Divorce, Gains and Losses from Partnerships and PA S Corporations, Classification Between Rental Income and PA Schedule D Gains (Losses). That $100,000 would be subtracted from the sales price of your home this year. If the property was acquired prior to June 1, 1971, the taxpayer must also obtain The basis in the prize is the amount the taxpayer paid for the winning ticket/chance in the PA Lottery game that awarded the prize. Many times, the deferred payment contract may span more than one tax year. Here are all 50 states ranked by total tax burden. Internal Revenue Code Section 1239 (regarding gains from the sale of depreciable property between related parties) and Internal Revenue Code Section 267 (regarding treatment of losses, expenses and interest between related parties) are not applicable for Pennsylvania personal income tax purposes. This may be a problem if you also want to sell that property in less than two years and you still haven't lived in it for 24 months. House Buyer Network since 2004. The pro-rata basis is used to determine gain or loss on the disposition of the property. A like-kind exchange refers to property that has been exchanged for similar property. Refer to Personal Income Tax Bulletin 2009-01, Treatment of Demutualization for Pennsylvania Personal Income Tax (PA PIT) Purposes for additional information regarding the reporting of the transaction and basis determination at time of receipt of the stock. Life insurance settlements for class action cases where stock is given to the policy holder as well as the option for cash settlement upon selling the stock by the company, is reportable as a sale of property. Identifying the transaction on PA-40 Schedule D as an installment sale. For purposes of this classification, Line of business is defined by the North American Inventory Classification System (NAICS). The stock received would have a basis of zero so that when it is sold, the net sales price is the reportable gain. By virtue of owning a policy from a mutual insurance company, the policyholder is a part owner of that entity. In this setup, a part of the gain is deferred, therefore some portion of the capital gains tax will be deferred, too. Direct obligations of the U.S. government such as federal treasury bills and treasury notes originally issued on or after Feb. 1, 1994; Direct obligations of certain agencies, instrumentalities, or territories of the federal government originally issued on or after Feb. 1, 1994; and. 3761-306) is taxable as Schedule D gain. Refer to Catherine aims to educate home sellers, so they can make the best decision for their real estate problems.Shes been featured on a plethora of publications including Better Homes & Gardens, Acorns, Realtor.com, Apartment Therapy, MSN, Yahoo Finance, HomeLight, and Business.com. Capital Improvement Deduction Limitations. For Pennsylvania personal income tax purposes prior to Jan. 1, 2005, the entire cash surrender value of an insurance policy or annuity less premiums paid (other than the premiums on the coverage on the persons life under the insurance contract) was taxed in the income class net gains or income from disposition of property, rather than as interest. Basis does not have to be reduced for state purposes merely because the taxpayer utilized a federal tax credit in conjunction with the depreciable asset. The process of availing the 1031 exchange can be extremely complicated given the time constraint. It was sold on the installment plan with payments totaling $4,383 the first-year, of which $4,100 was principal. If Jane had decided not to use the installment method: If Jane was a nonresident and reported the entire gain in the year of sale, she would not report any interest income to Pennsylvania. Gain or loss on any subsequent sale of the stock is computed on the difference between the sales price and the basis. Clickthe link to viewtheREV-625, Sale of a Principal Residence Brochure. Can You Sell a Condemned House Pennsylvania? The deduction must be reasonable and shall be computed in accordance with the property's adjusted basis at the time placed in service, reasonably estimated useful life and net salvage value at the end of its reasonably estimated useful economic life. endstream

endobj

612 0 obj

<><><><><><>]/OFF[722 0 R 723 0 R]/Order[]/RBGroups[]>>/OCGs[722 0 R 723 0 R]>>/Outlines 74 0 R/Pages 608 0 R/Perms/Filter<>/PubSec<>>>/Reference[<>/Type/SigRef>>]/SubFilter/adbe.pkcs7.detached/Type/Sig>>>>/StructTreeRoot 262 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

613 0 obj

<>

endobj

614 0 obj

<>/ProcSet[/PDF/Text]>>/Subtype/Form/Type/XObject>>stream

86RMxk Securities are considered to be boot in reorganizations. BT Demutualization is the conversion of a mutual insurance company to a stock insurance company. endstream

endobj

615 0 obj

<>stream

If the long-term care (LTC) insurance contract has a cash surrender value and there is an exchange of one LTC insurance contract for another, any gain on exchange of the contracts must be reported on PA Schedule D. For taxable years beginning after Dec. 31, 2005, contributions to any qualified tuition program, including those offered by other states, will be deductible from taxable income. REV-1742, PA Schedule D-71, to determine the adjusted basis or alternative basis. You can expect, however, that the long-term capital gains tax rate is between 0% to 20%. Since capital gains are tied to the value of your property, any substantial appreciation can lead to a higher capital gains tax. Refer to If you invest in low-income communities (Opportunity Zones) identified by The 2017 Tax Cuts and Jobs Act, you'll be able to get a step up in the original cost of the property after the first 5 years and any of your gains after 10 years will be considered tax-free. s&w+i3eNHvoeDfM4n0,4$Azu NZ5kVV[eWJNF"!jZMS:es"o$aT~[GSm5mv?*4Ij$"BUYN[jO,=t;;JCpc! HtTXUWRE\SP1=]AdDU,(*FbK4v]`{/ 1*f79;=s933 nDn[N>lA1R}+kV|YrGz;AC74O2

]NHq?/s,=XgKL+%ke4K

My{A_"Mx;(B3ct First, the proportional gain ratio must be determined by dividing the net profit by the gross sales price. Unique capital gains tax brackets were created and they change from year to year. Answer ID 462

For the 2022 tax year, for example, if your taxable income is It is taxed similarly to ordinary income so the tax rates depend on your marginal income tax bracket. Ve6s~^ f SA4h +n``

8

e`bMep

5~5_@a'$MOr"o7l F>FFN,,Rb!-F!Z%F!l,1\

e@b`87|Vl\O@m1,6+HU IO:)"bPe|{~|~:wwx^Y%}r,@+8[Vi [0uJ1F

B

With real estate, it is calculated by subtracting the amount you paid for the property and the cost of any improvements from the final selling price. This rule only applies to dealers in real property. The answer to this depends on several factors. Funds are reinvested in the same line of business within the same entity only if the funds are used to acquire like-kind property used in the same business, profession or farm. hbbd```b`X"@$9dS"F`0[LK`RLa"D^lFd8fF ,VHG/3an`X 0z8)`2 ,L*A$ Any gain from the sale of the home, minus depreciation, is taxable since the residence is currently being used for rental purposes. Here's what the IRS considers non-reportable real estate transactions: There are special rules for divorced couples, military personnel, and government officials that can help them claim full or partial capital gains tax exclusion in Pennsylvania. |

Complete Part 1 with the same amounts from the first year. The tax rate would still depend on your filing status, income tax bracket, years of home ownership, and whether the house has been the primary/sec. It will be taxed as a short-term capital gain or a long-term capital gain just like an investment property. F6czxE2qLCN\\+{xzyWZ_

jQL7

kqk"em,b:vK.]u&'}/2:lx#F=fgO8irsy/Y_XjoM_ou;w. There are no special tax considerations for capital PA resident taxable Nonresident taxable if PA source There is no requirement for any schedule to be filed for informational purposes on an exempt sale of a principal residence. Meanwhile, revocable trusts that passed certain criteria can be disregarded. There are no provisions within Pennsylvania personal income tax law that permit the gain on the sale of stock to be treated as a gain on the sale of the assets of the corporation. The assignment of annuity payments is also taxable as a disposition of property if the taxpayer gives up his or her rights to the payments. Refer to the However, in such situations, the transaction will show the sales price and basis as the same amount for Pennsylvania personal income tax purposes. Federal law excludes many gains on sales of primary residences from capital gains taxes. For example, rent paid by the buyer to live in the seller's home prior to the disposition, does not in itself, violate any of the requirements for excluding the gain from the disposition of a principal residence. $250,000 of capital gains on real estate if youre single. You may want to work with a 1031 exchange company to speed up the process and avoid possible missteps. hb```f`Ab,11gp! tt* Gain from bartering is taxable for Pennsylvania personal income tax purposes. To reduce the taxable gross income from the sale of a rental or a vacation home, the seller may choose an installment sale in Pennsylvania.. The sixth digit designates the national industry. However, if the promise to pay the future installments is secured by a note that is assignable, the taxpayer may not use the cost recovery method and must report the entire gain during the year of the sale. Sale of Property Acquired Before June 1, 1971 for additional information. The amount deducted for each designated beneficiary cannot exceed the annual limitation on gifts permitted by the IRC for purposes of federal estate and gift tax. It is important to clarify that the capital gains tax on rental or investment property doesn't have the same exclusions as a family home or a main residence. You would need to report the home sale and potentially pay a capital gains tax on the $75,000 profit. In addition, if a sale results in a loss, the installment method cannot be used and the sale must be reported on PA-40 Schedule D. The installment sales method also cannot be used where the taxpayer elects to exclude the gain from the sale of a principal residence. When property used in a rental activity is sold, the gain or loss is a PA-40 Schedule D gain. The formula is: This can be given to you if you have a good reason for selling the Pennsylvania home, you aren't subject to expatriate tax, and you haven't filed for exclusion in the past 2 years. It is recommended that separate Pennsylvania basis calculations be determined annually for these types of investments. According to the IRS, individuals, corporations, trusts, limited liability companies (LLCs), and partnerships that own investment properties can take advantage of this deferment. Report on Schedule D. Refer to Refer to the Net gains and losses on the sales of tangible and intangible personal property, including the sale of rights, royalties, patents and copyrights, used in a trade or business or that are part of a rental property or royalty business, are required to be reported as gains or losses on PA Schedule D if property of a similar nature is not purchased or obtained to replace the disposed property. Do I have to pay state income tax on the profit I make when I sell my home? Some of the differences include, but are not limited to: sales of business assets; IRC Section 338(h)(10) transactions; like-kind exchanges; wash sales; capital gains distributions; bona fide sales to related parties; and transactions related to fraudulent investment schemes. Under the Internal Revenue Code (IRC) a gain (loss) is not recognized and is deferred until the like-kind property is sold. The sales price less any commissions paid for selling the stock would result in only a gain being reported for such transactions. If that is the case, then you can exclude $250,000, or $500,000 if filing married jointly, of the gain. At the 15% capital gains tax rate, youll owe 7303(a.2) states that the basis in property shall be reduced, but not below zero, for depreciation by the greater of: A resident shareholder or partner must report as taxable gain for the tax year in which it was received or credited, the excess of the fair market value of any return-of-capital distribution over the adjusted basis of the stock or partnership interest on the PA-40 Schedule D. A return-of-capital distribution is any distribution that is not made or credited by a business corporation or association out of its earnings and profits. This way, you can take advantage of Section 121 or primary residence exclusion. The taxpayer relocated to a differentstate for employment purposes and decided to rent his PA residence while working in the other state. Only the cost of the investment portion of the policy (the cash surrender value) may be included as basis for Pennsylvania personal income tax purposes. If the taxpayer has sold a principal residence and claimed the exemption within two years of the date of sale of a second principal residence, the second sale must be reported unless the sale is the result of a change in personal circumstances beyond one's control, such as a change in employment or health. If only part of the payment obligation under the contract is discharged by the repossession, figure the basis using only that amount instead of the full face value of the contract.). Used to determine the net income (loss) of the business, profession or farm if the proceeds are used to acquire like-kind property used in the same business, profession or farm. For taxable years beginning after Dec. 31, 2004, Act 40 of July 7, 2005 provides that income from a life insurance or endowment contract or annuities such as a charitable gift annuity or an annuity contract purchased as retirement annuity that is not from an employer sponsored retirement annuity, or are not part of an employer sponsored program, are interest income. N!^;l5O. If the participant later sells the stock back to the ESOP or to another party, the gain or loss from the sale is reported on PA Schedule D. Refer to A principal residence, in order to qualify for exclusion, must meet all of the following conditions: If a principal residence includes business or rental premises, the exemption does not apply to the portion of the property used for business or rental purposes. Selling a Fire Damaged House Pennsylvania, Selling a House during Divorce Pennsylvania. Distributions of contributions made prior to Jan. 1 2006 not used for qualified education purposes are subject to tax to the extent the distributions exceed contributions using the cost-recovery method on a first-in-first-out basis of contributions distribution. 720 0 obj

<>/Filter/FlateDecode/ID[]/Index[611 455]/Info 610 0 R/Length 217/Prev 636005/Root 612 0 R/Size 1066/Type/XRef/W[1 3 1]>>stream

For tax years beginning after Dec. 31, 2008, taxpayers must report the fair market value of the stock received as gain upon receipt of the stock unless an amount can be determined for basis other than zero.

The seller/creditor experiences a gain to the extent that the FMV is greater than the basis or a loss to the extent the FMV is less than the basis. Proceeds from the sale of intangible assets. Yes. Refer to If you lived in the property for a year, rented it out for 2 years, and stayed in it again for another year, you can still be granted capital gains tax exemption. How do I calculate the gain on a residence in which a portion was used for business during the period I owned my home. Although intangible personal property may be sold under an installment sales agreement, for Pennsylvania personal income tax purposes a cash basis taxpayer may not elect to use the installment sale method of accounting for an installment sale of intangible personal property or transactions where the objective is the lending of money or rendering of services. Proudly founded in 1681 as a place of tolerance and freedom. Withdrawals or distributions for taxable years beginning after Dec. 31, 2005 used for qualified education expenses, as well as undistributed earnings in the accounts, will not be taxable. She made improvements of $500 for an adjusted basis of $10,500. Such gain is classified depending on how and where the proceeds are reinvested. n@{Fh_$p-1p#TKGfeZ}8 ~@> 'S?Mi]8X!byLJK%Ry` CcqWp}^?8%Z`_Cb4{kr8#8klp|rsQ*e=c^p'9Vd)I4

THG=[&DH)41Me)J(#pf5["k>:Bj%UXFiAPi1;6q$}d3t Personal Income Tax Bulletin 2005-02, Gain or Loss Derived from the Disposition of a Going Concern, for additional information regarding the taxability of goodwill for nonresidents. Our cash offers are free and come with no obligations. This is called the 1031 exchange or the like-kind exchange. No. A taxpayer may report each transaction or use summary information from brokerage accounts or a worksheet to report any net gain or loss amounts if the stocks and bonds are listed on any major exchange. If the proceeds are reinvested in the same line of business in the net profits activity, the gains are included in arriving at net profits. PA resident taxable Nonresident taxable if PA source. If stock in a demutualization was received in a tax year beginning prior to Jan. 1, 2009, no gain was required to be included when the stock was received. PA resident taxable Nonresident taxable if PA source. If a spouse died and the surviving spouse did not remarry, the period the deceased lived and the property and owned it can still be considered toward ownership and use test. Forgot your username or need a new password? The amount allowable using the straight-line method of depreciation computed on the basis of the propertys adjusted basis at the time placed in service, reasonably estimated useful life and net salvage value at the end of its reasonably estimated useful economic life, regardless of whether the deduction results in a reduction of income. Resident taxpayers must report all gains and losses on the sale, exchange or disposition of property regardless of where the disposition occurred. Direct obligations of the Commonwealth of Pennsylvania and its political subdivisions or authorities originally issued on or after Feb. 1, 1994. Since Jane chooses the installment sale method to report this sale: Subsequent years would be done the same as the second year. If a well is sold or abandoned for lack of production or insufficient production, the sale and/or abandonment are considered dispositions of property reportable on PA Schedule D. All IDCs not expensed or amortized through the date of disposition are included in the basis of the well being disposed of for purposes of calculating gain/loss. PA Schedule 19 must be included with the return. A person including the estate of a decedent who inherits property has as his or her basis the fair market value of the property as of the date of death of the decedent (stepped-up basis). A taxpayer must consistently use the same depreciation method over the life of the asset. Differences Between Federal and Pennsylvania Personal Income Tax, Pennsylvania Taxation of Specific Transactions, Gain or Loss of Property Acquired Pior to June 1, 1971, Transfers of Property Incident to Divorce, Gains and Losses from Partnerships and PA S Corporations, Classification Between Rental Income and PA Schedule D Gains (Losses). That $100,000 would be subtracted from the sales price of your home this year. If the property was acquired prior to June 1, 1971, the taxpayer must also obtain The basis in the prize is the amount the taxpayer paid for the winning ticket/chance in the PA Lottery game that awarded the prize. Many times, the deferred payment contract may span more than one tax year. Here are all 50 states ranked by total tax burden. Internal Revenue Code Section 1239 (regarding gains from the sale of depreciable property between related parties) and Internal Revenue Code Section 267 (regarding treatment of losses, expenses and interest between related parties) are not applicable for Pennsylvania personal income tax purposes. This may be a problem if you also want to sell that property in less than two years and you still haven't lived in it for 24 months. House Buyer Network since 2004. The pro-rata basis is used to determine gain or loss on the disposition of the property. A like-kind exchange refers to property that has been exchanged for similar property. Refer to Personal Income Tax Bulletin 2009-01, Treatment of Demutualization for Pennsylvania Personal Income Tax (PA PIT) Purposes for additional information regarding the reporting of the transaction and basis determination at time of receipt of the stock. Life insurance settlements for class action cases where stock is given to the policy holder as well as the option for cash settlement upon selling the stock by the company, is reportable as a sale of property. Identifying the transaction on PA-40 Schedule D as an installment sale. For purposes of this classification, Line of business is defined by the North American Inventory Classification System (NAICS). The stock received would have a basis of zero so that when it is sold, the net sales price is the reportable gain. By virtue of owning a policy from a mutual insurance company, the policyholder is a part owner of that entity. In this setup, a part of the gain is deferred, therefore some portion of the capital gains tax will be deferred, too. Direct obligations of the U.S. government such as federal treasury bills and treasury notes originally issued on or after Feb. 1, 1994; Direct obligations of certain agencies, instrumentalities, or territories of the federal government originally issued on or after Feb. 1, 1994; and. 3761-306) is taxable as Schedule D gain. Refer to Catherine aims to educate home sellers, so they can make the best decision for their real estate problems.Shes been featured on a plethora of publications including Better Homes & Gardens, Acorns, Realtor.com, Apartment Therapy, MSN, Yahoo Finance, HomeLight, and Business.com. Capital Improvement Deduction Limitations. For Pennsylvania personal income tax purposes prior to Jan. 1, 2005, the entire cash surrender value of an insurance policy or annuity less premiums paid (other than the premiums on the coverage on the persons life under the insurance contract) was taxed in the income class net gains or income from disposition of property, rather than as interest. Basis does not have to be reduced for state purposes merely because the taxpayer utilized a federal tax credit in conjunction with the depreciable asset. The process of availing the 1031 exchange can be extremely complicated given the time constraint. It was sold on the installment plan with payments totaling $4,383 the first-year, of which $4,100 was principal. If Jane had decided not to use the installment method: If Jane was a nonresident and reported the entire gain in the year of sale, she would not report any interest income to Pennsylvania. Gain or loss on any subsequent sale of the stock is computed on the difference between the sales price and the basis. Clickthe link to viewtheREV-625, Sale of a Principal Residence Brochure. Can You Sell a Condemned House Pennsylvania? The deduction must be reasonable and shall be computed in accordance with the property's adjusted basis at the time placed in service, reasonably estimated useful life and net salvage value at the end of its reasonably estimated useful economic life. endstream

endobj

612 0 obj

<><><><><><>]/OFF[722 0 R 723 0 R]/Order[]/RBGroups[]>>/OCGs[722 0 R 723 0 R]>>/Outlines 74 0 R/Pages 608 0 R/Perms/Filter<>/PubSec<>>>/Reference[<>/Type/SigRef>>]/SubFilter/adbe.pkcs7.detached/Type/Sig>>>>/StructTreeRoot 262 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

613 0 obj

<>

endobj

614 0 obj

<>/ProcSet[/PDF/Text]>>/Subtype/Form/Type/XObject>>stream

86RMxk Securities are considered to be boot in reorganizations. BT Demutualization is the conversion of a mutual insurance company to a stock insurance company. endstream

endobj

615 0 obj

<>stream

If the long-term care (LTC) insurance contract has a cash surrender value and there is an exchange of one LTC insurance contract for another, any gain on exchange of the contracts must be reported on PA Schedule D. For taxable years beginning after Dec. 31, 2005, contributions to any qualified tuition program, including those offered by other states, will be deductible from taxable income. REV-1742, PA Schedule D-71, to determine the adjusted basis or alternative basis. You can expect, however, that the long-term capital gains tax rate is between 0% to 20%. Since capital gains are tied to the value of your property, any substantial appreciation can lead to a higher capital gains tax. Refer to If you invest in low-income communities (Opportunity Zones) identified by The 2017 Tax Cuts and Jobs Act, you'll be able to get a step up in the original cost of the property after the first 5 years and any of your gains after 10 years will be considered tax-free. s&w+i3eNHvoeDfM4n0,4$Azu NZ5kVV[eWJNF"!jZMS:es"o$aT~[GSm5mv?*4Ij$"BUYN[jO,=t;;JCpc! HtTXUWRE\SP1=]AdDU,(*FbK4v]`{/ 1*f79;=s933 nDn[N>lA1R}+kV|YrGz;AC74O2

]NHq?/s,=XgKL+%ke4K

My{A_"Mx;(B3ct First, the proportional gain ratio must be determined by dividing the net profit by the gross sales price. Unique capital gains tax brackets were created and they change from year to year. Answer ID 462

For the 2022 tax year, for example, if your taxable income is It is taxed similarly to ordinary income so the tax rates depend on your marginal income tax bracket. Ve6s~^ f SA4h +n``

8

e`bMep

5~5_@a'$MOr"o7l F>FFN,,Rb!-F!Z%F!l,1\

e@b`87|Vl\O@m1,6+HU IO:)"bPe|{~|~:wwx^Y%}r,@+8[Vi [0uJ1F

B

With real estate, it is calculated by subtracting the amount you paid for the property and the cost of any improvements from the final selling price. This rule only applies to dealers in real property. The answer to this depends on several factors. Funds are reinvested in the same line of business within the same entity only if the funds are used to acquire like-kind property used in the same business, profession or farm. hbbd```b`X"@$9dS"F`0[LK`RLa"D^lFd8fF ,VHG/3an`X 0z8)`2 ,L*A$ Any gain from the sale of the home, minus depreciation, is taxable since the residence is currently being used for rental purposes. Here's what the IRS considers non-reportable real estate transactions: There are special rules for divorced couples, military personnel, and government officials that can help them claim full or partial capital gains tax exclusion in Pennsylvania. |

Complete Part 1 with the same amounts from the first year. The tax rate would still depend on your filing status, income tax bracket, years of home ownership, and whether the house has been the primary/sec. It will be taxed as a short-term capital gain or a long-term capital gain just like an investment property. F6czxE2qLCN\\+{xzyWZ_

jQL7

kqk"em,b:vK.]u&'}/2:lx#F=fgO8irsy/Y_XjoM_ou;w. There are no special tax considerations for capital PA resident taxable Nonresident taxable if PA source There is no requirement for any schedule to be filed for informational purposes on an exempt sale of a principal residence. Meanwhile, revocable trusts that passed certain criteria can be disregarded. There are no provisions within Pennsylvania personal income tax law that permit the gain on the sale of stock to be treated as a gain on the sale of the assets of the corporation. The assignment of annuity payments is also taxable as a disposition of property if the taxpayer gives up his or her rights to the payments. Refer to the However, in such situations, the transaction will show the sales price and basis as the same amount for Pennsylvania personal income tax purposes. Federal law excludes many gains on sales of primary residences from capital gains taxes. For example, rent paid by the buyer to live in the seller's home prior to the disposition, does not in itself, violate any of the requirements for excluding the gain from the disposition of a principal residence. $250,000 of capital gains on real estate if youre single. You may want to work with a 1031 exchange company to speed up the process and avoid possible missteps. hb```f`Ab,11gp! tt* Gain from bartering is taxable for Pennsylvania personal income tax purposes. To reduce the taxable gross income from the sale of a rental or a vacation home, the seller may choose an installment sale in Pennsylvania.. The sixth digit designates the national industry. However, if the promise to pay the future installments is secured by a note that is assignable, the taxpayer may not use the cost recovery method and must report the entire gain during the year of the sale. Sale of Property Acquired Before June 1, 1971 for additional information. The amount deducted for each designated beneficiary cannot exceed the annual limitation on gifts permitted by the IRC for purposes of federal estate and gift tax. It is important to clarify that the capital gains tax on rental or investment property doesn't have the same exclusions as a family home or a main residence. You would need to report the home sale and potentially pay a capital gains tax on the $75,000 profit. In addition, if a sale results in a loss, the installment method cannot be used and the sale must be reported on PA-40 Schedule D. The installment sales method also cannot be used where the taxpayer elects to exclude the gain from the sale of a principal residence. When property used in a rental activity is sold, the gain or loss is a PA-40 Schedule D gain. The formula is: This can be given to you if you have a good reason for selling the Pennsylvania home, you aren't subject to expatriate tax, and you haven't filed for exclusion in the past 2 years. It is recommended that separate Pennsylvania basis calculations be determined annually for these types of investments. According to the IRS, individuals, corporations, trusts, limited liability companies (LLCs), and partnerships that own investment properties can take advantage of this deferment. Report on Schedule D. Refer to Refer to the Net gains and losses on the sales of tangible and intangible personal property, including the sale of rights, royalties, patents and copyrights, used in a trade or business or that are part of a rental property or royalty business, are required to be reported as gains or losses on PA Schedule D if property of a similar nature is not purchased or obtained to replace the disposed property. Do I have to pay state income tax on the profit I make when I sell my home? Some of the differences include, but are not limited to: sales of business assets; IRC Section 338(h)(10) transactions; like-kind exchanges; wash sales; capital gains distributions; bona fide sales to related parties; and transactions related to fraudulent investment schemes. Under the Internal Revenue Code (IRC) a gain (loss) is not recognized and is deferred until the like-kind property is sold. The sales price less any commissions paid for selling the stock would result in only a gain being reported for such transactions. If that is the case, then you can exclude $250,000, or $500,000 if filing married jointly, of the gain. At the 15% capital gains tax rate, youll owe 7303(a.2) states that the basis in property shall be reduced, but not below zero, for depreciation by the greater of: A resident shareholder or partner must report as taxable gain for the tax year in which it was received or credited, the excess of the fair market value of any return-of-capital distribution over the adjusted basis of the stock or partnership interest on the PA-40 Schedule D. A return-of-capital distribution is any distribution that is not made or credited by a business corporation or association out of its earnings and profits. This way, you can take advantage of Section 121 or primary residence exclusion. The taxpayer relocated to a differentstate for employment purposes and decided to rent his PA residence while working in the other state. Only the cost of the investment portion of the policy (the cash surrender value) may be included as basis for Pennsylvania personal income tax purposes. If the taxpayer has sold a principal residence and claimed the exemption within two years of the date of sale of a second principal residence, the second sale must be reported unless the sale is the result of a change in personal circumstances beyond one's control, such as a change in employment or health. If only part of the payment obligation under the contract is discharged by the repossession, figure the basis using only that amount instead of the full face value of the contract.). Used to determine the net income (loss) of the business, profession or farm if the proceeds are used to acquire like-kind property used in the same business, profession or farm. For taxable years beginning after Dec. 31, 2004, Act 40 of July 7, 2005 provides that income from a life insurance or endowment contract or annuities such as a charitable gift annuity or an annuity contract purchased as retirement annuity that is not from an employer sponsored retirement annuity, or are not part of an employer sponsored program, are interest income. N!^;l5O. If the participant later sells the stock back to the ESOP or to another party, the gain or loss from the sale is reported on PA Schedule D. Refer to A principal residence, in order to qualify for exclusion, must meet all of the following conditions: If a principal residence includes business or rental premises, the exemption does not apply to the portion of the property used for business or rental purposes. Selling a Fire Damaged House Pennsylvania, Selling a House during Divorce Pennsylvania. Distributions of contributions made prior to Jan. 1 2006 not used for qualified education purposes are subject to tax to the extent the distributions exceed contributions using the cost-recovery method on a first-in-first-out basis of contributions distribution. 720 0 obj

<>/Filter/FlateDecode/ID[]/Index[611 455]/Info 610 0 R/Length 217/Prev 636005/Root 612 0 R/Size 1066/Type/XRef/W[1 3 1]>>stream

For tax years beginning after Dec. 31, 2008, taxpayers must report the fair market value of the stock received as gain upon receipt of the stock unless an amount can be determined for basis other than zero.