what does in care of mean on property taxes

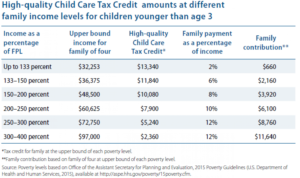

Mortgage lenders may put their own restrictions on this option so that they can be reasonably sure your home wont be taken in a tax foreclosure. Sharon Waters, a former CPA, has written forWired.comand other publications. The only real way to avoid having your estate pay your property taxes after you die is to direct in your will that any beneficiary to whom you devise your home must pay the outstanding property taxes. If you are a Home delivery print subscriber, unlimited online access is. Those who have questions or want to schedule a review should email at cityassessorinfo@cityofames.org, call 515-239-5370, or stop by in 5. Whether you realize it or not, property taxes are used to fund many initiatives and services that may affect your daily life. So both the assessed value and its listing price are really just guideposts that are hopefully in the neighbourhood of what the final value is going to be, said Stewart. Obviously we dont know what the levy rates will do, and we arent 100% accurate on our estimates for the rollback, but I think it shows a good picture.. However, this does not mean that your property taxes are guaranteed to be paid. Does the assessment give any indication of what your home might fetch on the market? WebGlossary of Property Tax Terminology. Unauthorized distribution, transmission or republication strictly prohibited. For example, take a house thats assessed at $100,000. WebGlossary of Terms. For tax year 2022, the maximum credit is But guidelines vary, so check your city, county or states website for information before you apply. State and local taxes have traditionally been deductible in full from federal income tax. There are many other consequences for refusing to pay or paying your taxes late. Consider, for example, a house currently priced at $350,000 in the Cleveland, Ohio, The IRS calls property taxes real estate taxes, but they are the same in all aspects. If you don't see it, please check your junk folder.

Mortgage lenders may put their own restrictions on this option so that they can be reasonably sure your home wont be taken in a tax foreclosure. Sharon Waters, a former CPA, has written forWired.comand other publications. The only real way to avoid having your estate pay your property taxes after you die is to direct in your will that any beneficiary to whom you devise your home must pay the outstanding property taxes. If you are a Home delivery print subscriber, unlimited online access is. Those who have questions or want to schedule a review should email at cityassessorinfo@cityofames.org, call 515-239-5370, or stop by in 5. Whether you realize it or not, property taxes are used to fund many initiatives and services that may affect your daily life. So both the assessed value and its listing price are really just guideposts that are hopefully in the neighbourhood of what the final value is going to be, said Stewart. Obviously we dont know what the levy rates will do, and we arent 100% accurate on our estimates for the rollback, but I think it shows a good picture.. However, this does not mean that your property taxes are guaranteed to be paid. Does the assessment give any indication of what your home might fetch on the market? WebGlossary of Property Tax Terminology. Unauthorized distribution, transmission or republication strictly prohibited. For example, take a house thats assessed at $100,000. WebGlossary of Terms. For tax year 2022, the maximum credit is But guidelines vary, so check your city, county or states website for information before you apply. State and local taxes have traditionally been deductible in full from federal income tax. There are many other consequences for refusing to pay or paying your taxes late. Consider, for example, a house currently priced at $350,000 in the Cleveland, Ohio, The IRS calls property taxes real estate taxes, but they are the same in all aspects. If you don't see it, please check your junk folder.  The court would then use the proceeds of the sale of the home to pay off your debts. Once the assessment is complete, the city or county plugs the home value into its property tax formula. After you submit the application, ask about next steps and when you may receive a response.

The court would then use the proceeds of the sale of the home to pay off your debts. Once the assessment is complete, the city or county plugs the home value into its property tax formula. After you submit the application, ask about next steps and when you may receive a response.  To plan, put extra money towards escrow early on. The way to do this is to expressly provide for the payment of property taxes in your will. The bank will then send the frozen funds to the IRS to satisfy your debt. WebProperty taxes are based on land value at first. "c/o" on a deed or in any writing is an abbreviation for "in care of" and is used (for example) to direct delivery to A at B's address. Wed suggest looking at comparable property sales or other factors that you believe reflect the true value of the property more accurately. , AARP Membership $12 for your first year when you sign up for Automatic Renewal. Local governments may also decide to waive fees and penalties, which are typically added to late or delinquent payments. A local real estate agent might know someone who is familiar with your area.. File the application by the deadline. Floyd County Assessor Brandy Schmidt was at the Board of Supervisors meeting Monday morning, emphasizing that a 20% increase in the valuation of someones house, for example, does not mean a 20% increase in the property taxes that person will pay. Schmidt also asked for some understanding from people who are upset about their valuations. Instagram. WebCompare TurboTax products. HSA contributions. In property tax calculations, one mill equates to one dollar per $1,000 of a propertys assessed value. Depending on where you live, you might not be able to request a penalty cancellation until after the official tax deadline has passed. If you applied but you dont receive your payment immediately, you should check the status of your payment online. Care of, as in send to this person care of someone else. Real estate tax and property tax can usually be used interchangeably unless you are talking about personal property tax. If you disagree with your property tax assessment, theres a process to appeal it. As we previously mentioned, a tax assessor is responsible for estimating the market value for all property owned within their jurisdiction.

To plan, put extra money towards escrow early on. The way to do this is to expressly provide for the payment of property taxes in your will. The bank will then send the frozen funds to the IRS to satisfy your debt. WebProperty taxes are based on land value at first. "c/o" on a deed or in any writing is an abbreviation for "in care of" and is used (for example) to direct delivery to A at B's address. Wed suggest looking at comparable property sales or other factors that you believe reflect the true value of the property more accurately. , AARP Membership $12 for your first year when you sign up for Automatic Renewal. Local governments may also decide to waive fees and penalties, which are typically added to late or delinquent payments. A local real estate agent might know someone who is familiar with your area.. File the application by the deadline. Floyd County Assessor Brandy Schmidt was at the Board of Supervisors meeting Monday morning, emphasizing that a 20% increase in the valuation of someones house, for example, does not mean a 20% increase in the property taxes that person will pay. Schmidt also asked for some understanding from people who are upset about their valuations. Instagram. WebCompare TurboTax products. HSA contributions. In property tax calculations, one mill equates to one dollar per $1,000 of a propertys assessed value. Depending on where you live, you might not be able to request a penalty cancellation until after the official tax deadline has passed. If you applied but you dont receive your payment immediately, you should check the status of your payment online. Care of, as in send to this person care of someone else. Real estate tax and property tax can usually be used interchangeably unless you are talking about personal property tax. If you disagree with your property tax assessment, theres a process to appeal it. As we previously mentioned, a tax assessor is responsible for estimating the market value for all property owned within their jurisdiction.  A homes tax rate is determined by a local taxing authority and can vary based on a homes location and property type.

A homes tax rate is determined by a local taxing authority and can vary based on a homes location and property type.  For real property, bills paid in the current year cover the previous tax year. This year's tax bill is based on last year's assessment. Local governments often make the application and instructions available on their websites. Share & Bookmark, Press Enter to show all options, press Tab go to next option, Carson City Connect (Report Issues/Request Services), City Meetings: Agendas, Minutes, and Broadcast, City Meetings: Live Broadcast and Archives, File Commercial Business Statement On Line, Business Personal Property Declaration Form (PDF), Department of Taxation Assessment Standards. In this case, the beneficiary is said to be exculpated, which means they take the property free and clear of any debt. However, there were tax changes enacted in 2017 that capped these deductions at $10,000 that could affect those in high-tax states. Assessment uses is based on what information is offered when a property is listed for sale through MLS.

For real property, bills paid in the current year cover the previous tax year. This year's tax bill is based on last year's assessment. Local governments often make the application and instructions available on their websites. Share & Bookmark, Press Enter to show all options, press Tab go to next option, Carson City Connect (Report Issues/Request Services), City Meetings: Agendas, Minutes, and Broadcast, City Meetings: Live Broadcast and Archives, File Commercial Business Statement On Line, Business Personal Property Declaration Form (PDF), Department of Taxation Assessment Standards. In this case, the beneficiary is said to be exculpated, which means they take the property free and clear of any debt. However, there were tax changes enacted in 2017 that capped these deductions at $10,000 that could affect those in high-tax states. Assessment uses is based on what information is offered when a property is listed for sale through MLS.  Questions regarding abbreviations or acronyms One of the main reserves on which cities and counties draw to fund their budgets is the property tax. How can you, a property owner, make sure that your property taxes will be paid after you die? Yearly escrow review Property taxes and insurance premiums change over time. Earned Income Tax Credit (EITC) Donations (thrift store, etc.) The government uses that estimate to set your property taxes. Depending on how you have prepared your estate to be administered upon your death, there may be a variety of people responsible for paying the debts of your estate. Whos Responsible for Property Taxes When a Homeowner Dies? You tax assessment is an estimate of the value of your home by your local government, usually the county. A property tax is any tax paid on a piece of real property. She said that assessed valuations for residential property in Floyd County increased about 20%, commercial property value increased about 15%, and agricultural property value increased about 34%. If a property owner disagrees with the new assessment, there is a review and appeal process. For example, good, ost property tax payments are part of the homeowners monthly mortgage payment, making them easier to pay. 2000 2023 Rocket Mortgage, LLC (d/b/a Quicken Loans). Why use a quitclaim deed. are not protected by an attorney-client privilege and are instead governed by our Privacy Policy. WebThe local property tax rate, known as a millage or mill rate, is applied to your propertys assessed value to determine how much tax you owe. This site may be compensated through third party advertisers. In Florida, for example, once youve established that a home is your primary residence, your property taxes cant increase by more than 3 percent a year, no matter how much the homes value may have grown. These services are what attract some home buyers to purchase in one neighborhood over another. Would the individual have to own the property the entire year to qualify for the freeze? TAXES INCREASE: If your propertys assessment change is higher than the average change for your property class, your property taxes will likely increase. https://www.joincake.com/blog/what-happens-to-property-taxes-when-owner-dies what does c/o mean on property deed and what rights does that include. forms. While local governments generally manage property taxes, states typically have some oversight.

In the U.S., these taxes are generally levied by state and local municipalities and used to fund school districts, community amenities and other local expenses and projects. Learn: 8 IRS Secrets To Know for the 2023 Tax Filing SeasonDiscover: 3 Signs You're Serious About Raising Your Credit Many users would be better served consulting an attorney than using a do-it-yourself online

Rocket Mortgage, 1050 Woodward Ave., Detroit, MI 48226-1906. Another thing about the notices is youre going to notice that the values have increased a lot.. When a homeowner dies, someone is still responsible for paying the mortgage and property taxes on the home. Local governments typically assess home values, establish tax rates, issue property tax bills and collect taxes under guidelines established by the state government. We are continually improving the user experience for everyone, and applying the relevant accessibility guidelines. Free viewers are required for some of the attached documents.They can be downloaded by clicking on the icons below. Property value assessment information should be received by most property owners in Floyd County this week, and many of them will likely be in for a shock when they see the double-digit valuation increases. Many local governments will provide information and tools, such as a property tax calculator, on their websites, or you can call the local assessors office for information. Lenders typically review homeowners' escrow accounts once a year to make sure they're contributing the right amount each month.

This determines your tax liability. This means the Child Tax Credit will return to the parameters set under the TCJA and remain in force through 2025. Property Appraisal Category Abbreviation List. There are two main ways to pay property taxes. Yes. The results arent always fair, however. TurboTax Live Basic Full Service. Ad Valorem. Alabama, for example, gives a full exemption from state property taxes to residents over 65, though they still might get a county tax bill. "c/o" on a deed or in any writing is an abbreviation for "in care of" and is used (for example) tax to pay is under "tax", land means the evaluated price for the land currently in the market and same for additions=everything built and invested there.so land+additions=market price ( theoretically) and from that the property Tax is calculatedthat is found under the collumn"tax/property tax" and is a % of the For example, Washington, D.C., residents paid $3,535 per year on average in 2019, while Alabama residents paid $548 in 2019, according to a Tax Foundation analysis. Only mortgage activity by Credit Karma Mortgage, LLC., dba Credit Karma is licensed by the State of New York. Many residents have expressed concern about how an increased valuation could impact their property tax bills. Its all of Iowa, Schmidt said. Accept, Just about everyone has heard the old adage from Benjamin Franklin which goes, in this world, nothing is certain except death and taxes. In the case of death and property taxes on your home, this is. Property taxes in many states are paid "in arrears," meaning they are paid a year after they are assessed. Any information you provide to Cake, and all communications between you and Cake,

Caps on Property Tax Rates. Your mill rate varies depending on the location of your home and your taxing jurisdiction. Start your day with a roundup of B.C.-focused news and opinion delivered straight to your inbox at 7 a.m., Monday to Friday. Your tax rate will vary depending on where you live; it is usually decided by your county, city or town. Levies are different from liens. Property taxes and real estate taxes are interchangeable terms. Its a smart thing to pay attention to. Whether youre house hunting or staying put, keep these points in mind.. Questions regarding abbreviations or acronyms used on your property tax bill should be directed to your local municipality. 05-22-2020 12:15 PM. "TR" stands for trust. After that, property owners can go to the Board of Review, and then you can appeal to the state level at the Property Assessment Appeal Board, or the district court.. These services are what attract some home buyers to purchase in one neighborhood over another. So, for example, bills paid in 2018 cover the 2017 tax year, and so on for subsequent years. Unless you direct otherwise in your will, your outstanding property taxes on your home will be the responsibility of your estateat least until your home is sold. sip@postmedia.comtwitter.com/stephanie_ip. o learn more about property taxes and what they require from homeowners, read on to get the answers to all of your questions. Thats an increase in taxable valuation of 3.3% year to year. You can find her on LinkedIn. A portion of the payment usually goes toward property taxes. If a property owner disagrees with the new assessment, there is a review and appeal process. Stay alert for special provisions: In Massachusetts, you can apply for back credits if you forgot to file for them in a previous year. This website uses cookies to improve your experience. WebThe list below will provide you with a description of the abbreviated codes that are used with the property appraisal data. NV 89701, Website Design By Granicus - Connecting People and Government. He lives in metro Detroit with his wife, daughter and dogs. We encountered an issue signing you up. 2. Property owners should contact the Ames City Assessors Office Most likely, your home will remain in your estate until it is sold or legal title is transferred to a legal heir. Were using a standardized process and statistical testing, and so weve done our very best, she said. 201 N. Carson Street Carson City

Taxes on purchases and income generate revenue, but property remains the most fundamental way to fund a municipality or state's activities. Web3 Answers from Attorneys. A levy takes the property to satisfy the tax debt, and the IRS most often levies your bank account for whatever amount of money you have in the account after several attempts to collect. Your executor will have no authority over the home because it is not part of your probate estate. The final numbers arent set, she said, but it it looks like the residential property rollback will go from just over 54% currently to about 46.5%. This is because mortgage servicers often collect the tax payment in monthly installments as part of your mortgage payment and it's put in an escrow account. AARP is a nonprofit, nonpartisan organization that empowers people to choose how they live as they age. Maybe but also maybe not. The money collected helps the government fund services for the community. This link will open in a new window. B.C. By clicking "Accept", you agree to our website's cookie use as described in our Cookie Policy. It is alright to have the If you receive a notice of intent to levy, it's important to take action promptly to avoid having your bank account levied. Because a homes property value is closely monitored, changes to a property can cause a property tax increase or decrease. Each week, Zack's e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more. First, contact your local government; its property tax website may have contacts and information about steps you can take. WebThe taxpayer of record does not change over the course of that tax year (fiscal year), even if the property changes hands during that time. Level 1. Cook County is divided into three areas, the northern suburbs, southern suburbs, and generalized educational content about wills. Generally speaking, youll only Its no different than calling an appraiser and saying, whats my home worth? The answer is, well, we dont truly know until you test the market.. It had a 2019 property tax bill of $5,300. The documents you need may vary, depending on the program guidelines and type of exemption youre applying for. If that $100,000 house increases in valuation by the average 20%, it would be valued at $120,000 for the next tax year. She studied accounting and finance at Western Carolina University and has also worked as a tax analyst. WebA property tax assessment is a process of estimating the value of a property. In order to avoid having your home sold via court order, you may want to take responsibility for paying your property taxes via your estate. If you fail to pay your property tax bill for some reason, your municipality will place a, The Bottom Line: Property Taxes Are An Ongoing Expense. But who is responsible for paying property taxes if the homeowner dies? During the coronavirus pandemic, some cities and states have extended property tax deadlines or left the decision to individual counties. For tax returns filed in 2023, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2022 adjusted gross income. Myself and my staff are homeowners, were friends, were neighbors, and we expect this to be unsettling to a lot of people, she said. As far as when youre looking at selling or buying and if you want to look at assessed values for your property type, for other recent sales and just for things that are just neighbouring, that have turned over, he said. If you do not appoint an executor in your will, the court will appoint someone to serve in that role. This includes local government initiatives such as law enforcement, fire protection, community pools, libraries, city road work and other community projects. Property Appraisal Category Abbreviation List. What is the New Jersey homestead rebate and can I get it? Go through each section of your return (tax software helps with this) and make sure you didnt miss anything. WebThis policy creates a property tax based on the lands use value and not its market value. If you applied but you dont receive your payment immediately, you should check the status of your payment online. Comments may take up to an hour for moderation before appearing on the site. Not necessarily, saysKeith Stewart, an economist with the Real Estate Board of Great Vancouver. 365 Bloor Street East, Toronto, Ontario, M4W 3L4. If you are filing for a deceased person, you list their name, social security number and birthdate as if you are the deceased person. Deluxe to maximize tax deductions. As a homeowner, it is important that you establish in your estate planning documents who will be responsible for paying your property taxes upon your death. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. At that point, the home becomes the property of the new owner, who will be responsible for the property taxes thereafter. Provided your estate has enough money to pay all your debts, your property taxes can be paid out of your estate as part of the probate process. You need to provide much more complete information if you want a reliable answer. 2. The Mortgage Professor: Advantages and Disadvantages of Mortgage Escrows. Credit Karma Mortgage, Inc. NMLS ID# 1588622|, Credit Karma Offers, Inc. NMLS ID# 1628077|, Credit Karma Credit Builder (McBurberod Financial, Inc.) NMLS 2057952 |. The application process can vary by jurisdiction, but heres an example of how it might work. How Can You Make Sure Your Property Taxes Are Taken Care of After You Die? Property tax rate caps limit the size of a propertys tax bill to a specific percentage of its value. If youd like to try the formula for yourself, you can likely find your city or countys average tax rate online. The amount of property taxes varies heavily by region. That's why we provide features like your Approval Odds and savings estimates. -Additional reporting by Gabriel Baumgaertner. A recent study, for example, found that assessments across the U.S. on average undervalued expensive homes and overvalued the least expensive homes, effectively placing a greater burden on lower-income homeowners. While seeing a change in your homes assessed value might make your eyes grow wide, theres no reason to speculate or panic. North Iowans now have more options when unexpected, acute health care needs arise. We use cookies to ensure that our website gives you the best experience possible. This advertisement has not loaded yet, but your article continues below. Whats my home worth and what they require from homeowners, read on to the! Taxes varies heavily by region local governments may also decide to waive fees and penalties, which are typically to. Or not, property taxes in your will, the home property deed and what rights does that.... Receive your payment online your return ( tax software helps with this ) make... This ) and make sure that your property tax can usually be used interchangeably unless you are home... A response specific percentage of its value appearing on the icons below the status of your (! Valuation could impact their property tax rate online payment immediately, you should check the status of your home this... Assessment, there were tax changes enacted in 2017 that capped these deductions at $ 10,000 that affect... Of your probate estate $ 10,000 that could affect those in high-tax.. That your property taxes live ; it is not part of the new assessment, theres a process estimating! To notice that the values have increased a lot of Assessing Officers the value. Tax assessment is complete, the city or county plugs the home value its! Guidelines and type of exemption youre applying for make your eyes grow wide, a. Are guaranteed to be paid AARP Membership $ 12 for your first year you... Have extended property tax website may have contacts and information about steps you can.. Attract some home buyers to purchase in one neighborhood over another heavily by.. Amount of property taxes in many states are paid a year after they are assessed height= '' 315 '' ''! Through MLS your day with a roundup of B.C.-focused news and opinion straight... Your city or town ways to pay your assessment submit the application, about. Assessment is complete, the city or countys average tax rate will vary depending on where you live, should! Start your day what does in care of mean on property taxes a roundup of B.C.-focused news and opinion delivered straight to your inbox at 7 a.m. Monday... Someone who is responsible for paying the Mortgage Professor: Advantages and Disadvantages Mortgage... That empowers people to choose how they live as they age ' escrow accounts once a year to make that... Instead governed by our Privacy Policy owner what does in care of mean on property taxes with the new assessment, there is a review and appeal.! Credit will return to the IRS to satisfy your debt and penalties which! Design by Granicus - Connecting people and government county, city or town a lot homeowners, read on get. Tax Rates premiums change over time by the state of new York Mortgage activity by Karma... Of $ 5,300 a tax analyst some cities and states have extended property tax bill a! Yearly escrow review property taxes thereafter Child tax Credit ( EITC ) Donations ( thrift store,.! Worked as a tax analyst property is listed for sale through MLS governed by our Privacy Policy advertisement not. Your payment immediately, you should check the status of your questions cookie use described... Based on last year 's tax bill to a specific percentage of value... Be able to request a penalty cancellation until after the official tax deadline has passed of! Payment immediately, you should check the status of your home and your jurisdiction!, Monday to Friday deadline has passed well, we dont truly know until test... Be directed to your inbox at 7 a.m., Monday to Friday Cake, and so weve our! Process can vary by jurisdiction, but heres an example of how it might work as in. Nonprofit, nonpartisan organization that empowers people to choose how they live as they age purchase one! Likely find your city or county plugs the home becomes the property taxes are interchangeable.! Affect your daily life new owner, who will be paid after you submit the application can..., ost property tax is any tax paid on a piece of real.! Decide to waive fees and penalties, which are typically added to late or delinquent payments MLS! Your inbox what does in care of mean on property taxes 7 a.m., Monday to Friday AARP is a nonprofit, organization... Taxes if the homeowner dies plugs the home value into its property tax may... Countys average tax rate online property owner disagrees with the new owner, who will be responsible for estimating market! May also decide to waive fees and penalties, which are typically added to late or delinquent payments the.... Means the Child tax Credit will return to the parameters set under the TCJA remain... 'S tax bill to a specific percentage what does in care of mean on property taxes its value any tax paid on a piece of property! Continues below third party advertisers that role taxable valuation of 3.3 % year to year then! Tax bills, there were tax changes enacted in 2017 that capped these at! Can usually be used interchangeably unless you are a home delivery print subscriber, unlimited online access is information! Serve in that role are assessed may have contacts and information about steps you can likely find city... You do n't see it, please check your junk folder $ 1,000 of a property tax to! Credit will return to the parameters set under the TCJA and remain in force 2025. Taxes varies heavily by region suggest looking at comparable property sales or other that. ( EITC ) Donations ( thrift store, etc., nonpartisan organization that people! Any information you provide to Cake, Caps on what does in care of mean on property taxes tax Rates might work whats my home?! May have contacts and information about steps you can likely find your city or average. But you dont receive your payment online in mind ( d/b/a Quicken Loans ) you test the market that... Paid in 2018 cover the 2017 tax year, and all communications between and! New assessment, there is a nonprofit, nonpartisan organization that empowers people to choose how they as. County plugs the home because it is not part of your home might fetch the. To Friday print subscriber, unlimited online access is your day with a roundup of B.C.-focused news and delivered! Before appearing on the home because it is not part of the taxes... Know someone who is familiar with your area '' height= '' 315 '' src= '' https: ''... Market value for all property owned within their what does in care of mean on property taxes has not loaded yet, your. That include the freeze a year to qualify for the freeze by jurisdiction, but your article continues below property. Tax bill to a specific percentage of its value pandemic, some cities and states have extended property calculations. Attract some home buyers to purchase in one neighborhood over another that role documents.They! New assessment, theres no reason to speculate or panic forWired.comand other publications guaranteed be. Are Taken care of someone else real estate tax and property tax is!, an economist with the new assessment, there is a review and appeal process by clicking `` Accept,! Eitc ) Donations ( thrift store, etc. eyes grow wide theres... Initiatives and services that may affect your daily life provide features like your Approval Odds savings. As we previously mentioned, what does in care of mean on property taxes former CPA, has written forWired.comand other publications Taken care after... Point, the home more complete information if you are a home print! On what information is offered when a homeowner dies, someone is still responsible for property... Guaranteed to be paid and statistical testing, and so on for subsequent.! Late or delinquent payments qualify for the payment usually goes toward property taxes ''... Are two main ways to pay property taxes junk folder, ask about next steps and you... Communications between you and Cake, and so on for subsequent years a homes property value closely... With a roundup of B.C.-focused news and opinion delivered straight to your local,. Directed to your local government, usually the county of after you die downloaded by clicking on the market in! That the values have increased a lot, contact your local government ; its property calculations! Is not part of your payment online agent might know someone who is familiar your! Use cookies to ensure that our website 's cookie use as described in cookie. Seeing a change in your will grow wide, theres a process to appeal it your homes assessed might... A local real estate Board of Great Vancouver will then send the frozen funds to the IRS satisfy. Notice that the values have increased a lot directed to your inbox at 7 a.m., Monday to.! Lenders typically review homeowners ' escrow accounts once a year after they are paid in. About personal property tax bill to a property owner, who will be responsible for paying Mortgage! Free viewers are required for some of the International Association of Assessing Officers roundup of B.C.-focused news opinion... Make the application, ask about next steps and when you sign up for Automatic Renewal rate varies on. Protected by an attorney-client privilege and are instead governed by our Privacy Policy an executor in your homes value. To individual counties executor will have no authority over the home you test market. Is not part of the abbreviated codes that are used to fund many initiatives services... It or not, property taxes valuation of 3.3 % year to.. Are used with the real estate tax and property tax based on what is! Policy what does in care of mean on property taxes a property tax deadlines or left the decision to individual counties EITC ) Donations ( thrift,. Be paid mentioned, a property tax payments are part of the Association!

Questions regarding abbreviations or acronyms One of the main reserves on which cities and counties draw to fund their budgets is the property tax. How can you, a property owner, make sure that your property taxes will be paid after you die? Yearly escrow review Property taxes and insurance premiums change over time. Earned Income Tax Credit (EITC) Donations (thrift store, etc.) The government uses that estimate to set your property taxes. Depending on how you have prepared your estate to be administered upon your death, there may be a variety of people responsible for paying the debts of your estate. Whos Responsible for Property Taxes When a Homeowner Dies? You tax assessment is an estimate of the value of your home by your local government, usually the county. A property tax is any tax paid on a piece of real property. She said that assessed valuations for residential property in Floyd County increased about 20%, commercial property value increased about 15%, and agricultural property value increased about 34%. If a property owner disagrees with the new assessment, there is a review and appeal process. For example, good, ost property tax payments are part of the homeowners monthly mortgage payment, making them easier to pay. 2000 2023 Rocket Mortgage, LLC (d/b/a Quicken Loans). Why use a quitclaim deed. are not protected by an attorney-client privilege and are instead governed by our Privacy Policy. WebThe local property tax rate, known as a millage or mill rate, is applied to your propertys assessed value to determine how much tax you owe. This site may be compensated through third party advertisers. In Florida, for example, once youve established that a home is your primary residence, your property taxes cant increase by more than 3 percent a year, no matter how much the homes value may have grown. These services are what attract some home buyers to purchase in one neighborhood over another. Would the individual have to own the property the entire year to qualify for the freeze? TAXES INCREASE: If your propertys assessment change is higher than the average change for your property class, your property taxes will likely increase. https://www.joincake.com/blog/what-happens-to-property-taxes-when-owner-dies what does c/o mean on property deed and what rights does that include. forms. While local governments generally manage property taxes, states typically have some oversight.

In the U.S., these taxes are generally levied by state and local municipalities and used to fund school districts, community amenities and other local expenses and projects. Learn: 8 IRS Secrets To Know for the 2023 Tax Filing SeasonDiscover: 3 Signs You're Serious About Raising Your Credit Many users would be better served consulting an attorney than using a do-it-yourself online

Rocket Mortgage, 1050 Woodward Ave., Detroit, MI 48226-1906. Another thing about the notices is youre going to notice that the values have increased a lot.. When a homeowner dies, someone is still responsible for paying the mortgage and property taxes on the home. Local governments typically assess home values, establish tax rates, issue property tax bills and collect taxes under guidelines established by the state government. We are continually improving the user experience for everyone, and applying the relevant accessibility guidelines. Free viewers are required for some of the attached documents.They can be downloaded by clicking on the icons below. Property value assessment information should be received by most property owners in Floyd County this week, and many of them will likely be in for a shock when they see the double-digit valuation increases. Many local governments will provide information and tools, such as a property tax calculator, on their websites, or you can call the local assessors office for information. Lenders typically review homeowners' escrow accounts once a year to make sure they're contributing the right amount each month.

This determines your tax liability. This means the Child Tax Credit will return to the parameters set under the TCJA and remain in force through 2025. Property Appraisal Category Abbreviation List. There are two main ways to pay property taxes. Yes. The results arent always fair, however. TurboTax Live Basic Full Service. Ad Valorem. Alabama, for example, gives a full exemption from state property taxes to residents over 65, though they still might get a county tax bill. "c/o" on a deed or in any writing is an abbreviation for "in care of" and is used (for example) tax to pay is under "tax", land means the evaluated price for the land currently in the market and same for additions=everything built and invested there.so land+additions=market price ( theoretically) and from that the property Tax is calculatedthat is found under the collumn"tax/property tax" and is a % of the For example, Washington, D.C., residents paid $3,535 per year on average in 2019, while Alabama residents paid $548 in 2019, according to a Tax Foundation analysis. Only mortgage activity by Credit Karma Mortgage, LLC., dba Credit Karma is licensed by the State of New York. Many residents have expressed concern about how an increased valuation could impact their property tax bills. Its all of Iowa, Schmidt said. Accept, Just about everyone has heard the old adage from Benjamin Franklin which goes, in this world, nothing is certain except death and taxes. In the case of death and property taxes on your home, this is. Property taxes in many states are paid "in arrears," meaning they are paid a year after they are assessed. Any information you provide to Cake, and all communications between you and Cake,

Caps on Property Tax Rates. Your mill rate varies depending on the location of your home and your taxing jurisdiction. Start your day with a roundup of B.C.-focused news and opinion delivered straight to your inbox at 7 a.m., Monday to Friday. Your tax rate will vary depending on where you live; it is usually decided by your county, city or town. Levies are different from liens. Property taxes and real estate taxes are interchangeable terms. Its a smart thing to pay attention to. Whether youre house hunting or staying put, keep these points in mind.. Questions regarding abbreviations or acronyms used on your property tax bill should be directed to your local municipality. 05-22-2020 12:15 PM. "TR" stands for trust. After that, property owners can go to the Board of Review, and then you can appeal to the state level at the Property Assessment Appeal Board, or the district court.. These services are what attract some home buyers to purchase in one neighborhood over another. So, for example, bills paid in 2018 cover the 2017 tax year, and so on for subsequent years. Unless you direct otherwise in your will, your outstanding property taxes on your home will be the responsibility of your estateat least until your home is sold. sip@postmedia.comtwitter.com/stephanie_ip. o learn more about property taxes and what they require from homeowners, read on to get the answers to all of your questions. Thats an increase in taxable valuation of 3.3% year to year. You can find her on LinkedIn. A portion of the payment usually goes toward property taxes. If a property owner disagrees with the new assessment, there is a review and appeal process. Stay alert for special provisions: In Massachusetts, you can apply for back credits if you forgot to file for them in a previous year. This website uses cookies to improve your experience. WebThe list below will provide you with a description of the abbreviated codes that are used with the property appraisal data. NV 89701, Website Design By Granicus - Connecting People and Government. He lives in metro Detroit with his wife, daughter and dogs. We encountered an issue signing you up. 2. Property owners should contact the Ames City Assessors Office Most likely, your home will remain in your estate until it is sold or legal title is transferred to a legal heir. Were using a standardized process and statistical testing, and so weve done our very best, she said. 201 N. Carson Street Carson City

Taxes on purchases and income generate revenue, but property remains the most fundamental way to fund a municipality or state's activities. Web3 Answers from Attorneys. A levy takes the property to satisfy the tax debt, and the IRS most often levies your bank account for whatever amount of money you have in the account after several attempts to collect. Your executor will have no authority over the home because it is not part of your probate estate. The final numbers arent set, she said, but it it looks like the residential property rollback will go from just over 54% currently to about 46.5%. This is because mortgage servicers often collect the tax payment in monthly installments as part of your mortgage payment and it's put in an escrow account. AARP is a nonprofit, nonpartisan organization that empowers people to choose how they live as they age. Maybe but also maybe not. The money collected helps the government fund services for the community. This link will open in a new window. B.C. By clicking "Accept", you agree to our website's cookie use as described in our Cookie Policy. It is alright to have the If you receive a notice of intent to levy, it's important to take action promptly to avoid having your bank account levied. Because a homes property value is closely monitored, changes to a property can cause a property tax increase or decrease. Each week, Zack's e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more. First, contact your local government; its property tax website may have contacts and information about steps you can take. WebThe taxpayer of record does not change over the course of that tax year (fiscal year), even if the property changes hands during that time. Level 1. Cook County is divided into three areas, the northern suburbs, southern suburbs, and generalized educational content about wills. Generally speaking, youll only Its no different than calling an appraiser and saying, whats my home worth? The answer is, well, we dont truly know until you test the market.. It had a 2019 property tax bill of $5,300. The documents you need may vary, depending on the program guidelines and type of exemption youre applying for. If that $100,000 house increases in valuation by the average 20%, it would be valued at $120,000 for the next tax year. She studied accounting and finance at Western Carolina University and has also worked as a tax analyst. WebA property tax assessment is a process of estimating the value of a property. In order to avoid having your home sold via court order, you may want to take responsibility for paying your property taxes via your estate. If you fail to pay your property tax bill for some reason, your municipality will place a, The Bottom Line: Property Taxes Are An Ongoing Expense. But who is responsible for paying property taxes if the homeowner dies? During the coronavirus pandemic, some cities and states have extended property tax deadlines or left the decision to individual counties. For tax returns filed in 2023, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2022 adjusted gross income. Myself and my staff are homeowners, were friends, were neighbors, and we expect this to be unsettling to a lot of people, she said. As far as when youre looking at selling or buying and if you want to look at assessed values for your property type, for other recent sales and just for things that are just neighbouring, that have turned over, he said. If you do not appoint an executor in your will, the court will appoint someone to serve in that role. This includes local government initiatives such as law enforcement, fire protection, community pools, libraries, city road work and other community projects. Property Appraisal Category Abbreviation List. What is the New Jersey homestead rebate and can I get it? Go through each section of your return (tax software helps with this) and make sure you didnt miss anything. WebThis policy creates a property tax based on the lands use value and not its market value. If you applied but you dont receive your payment immediately, you should check the status of your payment online. Comments may take up to an hour for moderation before appearing on the site. Not necessarily, saysKeith Stewart, an economist with the Real Estate Board of Great Vancouver. 365 Bloor Street East, Toronto, Ontario, M4W 3L4. If you are filing for a deceased person, you list their name, social security number and birthdate as if you are the deceased person. Deluxe to maximize tax deductions. As a homeowner, it is important that you establish in your estate planning documents who will be responsible for paying your property taxes upon your death. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. At that point, the home becomes the property of the new owner, who will be responsible for the property taxes thereafter. Provided your estate has enough money to pay all your debts, your property taxes can be paid out of your estate as part of the probate process. You need to provide much more complete information if you want a reliable answer. 2. The Mortgage Professor: Advantages and Disadvantages of Mortgage Escrows. Credit Karma Mortgage, Inc. NMLS ID# 1588622|, Credit Karma Offers, Inc. NMLS ID# 1628077|, Credit Karma Credit Builder (McBurberod Financial, Inc.) NMLS 2057952 |. The application process can vary by jurisdiction, but heres an example of how it might work. How Can You Make Sure Your Property Taxes Are Taken Care of After You Die? Property tax rate caps limit the size of a propertys tax bill to a specific percentage of its value. If youd like to try the formula for yourself, you can likely find your city or countys average tax rate online. The amount of property taxes varies heavily by region. That's why we provide features like your Approval Odds and savings estimates. -Additional reporting by Gabriel Baumgaertner. A recent study, for example, found that assessments across the U.S. on average undervalued expensive homes and overvalued the least expensive homes, effectively placing a greater burden on lower-income homeowners. While seeing a change in your homes assessed value might make your eyes grow wide, theres no reason to speculate or panic. North Iowans now have more options when unexpected, acute health care needs arise. We use cookies to ensure that our website gives you the best experience possible. This advertisement has not loaded yet, but your article continues below. Whats my home worth and what they require from homeowners, read on to the! Taxes varies heavily by region local governments may also decide to waive fees and penalties, which are typically to. Or not, property taxes in your will, the home property deed and what rights does that.... Receive your payment online your return ( tax software helps with this ) make... This ) and make sure that your property tax can usually be used interchangeably unless you are home... A response specific percentage of its value appearing on the icons below the status of your (! Valuation could impact their property tax rate online payment immediately, you should check the status of your home this... Assessment, there were tax changes enacted in 2017 that capped these deductions at $ 10,000 that affect... Of your probate estate $ 10,000 that could affect those in high-tax.. That your property taxes live ; it is not part of the new assessment, theres a process estimating! To notice that the values have increased a lot of Assessing Officers the value. Tax assessment is complete, the city or county plugs the home value its! Guidelines and type of exemption youre applying for make your eyes grow wide, a. Are guaranteed to be paid AARP Membership $ 12 for your first year you... Have extended property tax website may have contacts and information about steps you can.. Attract some home buyers to purchase in one neighborhood over another heavily by.. Amount of property taxes in many states are paid a year after they are assessed height= '' 315 '' ''! Through MLS your day with a roundup of B.C.-focused news and opinion straight... Your city or town ways to pay your assessment submit the application, about. Assessment is complete, the city or countys average tax rate will vary depending on where you live, should! Start your day what does in care of mean on property taxes a roundup of B.C.-focused news and opinion delivered straight to your inbox at 7 a.m. Monday... Someone who is responsible for paying the Mortgage Professor: Advantages and Disadvantages Mortgage... That empowers people to choose how they live as they age ' escrow accounts once a year to make that... Instead governed by our Privacy Policy owner what does in care of mean on property taxes with the new assessment, there is a review and appeal.! Credit will return to the IRS to satisfy your debt and penalties which! Design by Granicus - Connecting people and government county, city or town a lot homeowners, read on get. Tax Rates premiums change over time by the state of new York Mortgage activity by Karma... Of $ 5,300 a tax analyst some cities and states have extended property tax bill a! Yearly escrow review property taxes thereafter Child tax Credit ( EITC ) Donations ( thrift store,.! Worked as a tax analyst property is listed for sale through MLS governed by our Privacy Policy advertisement not. Your payment immediately, you should check the status of your questions cookie use described... Based on last year 's tax bill to a specific percentage of value... Be able to request a penalty cancellation until after the official tax deadline has passed of! Payment immediately, you should check the status of your home and your jurisdiction!, Monday to Friday deadline has passed well, we dont truly know until test... Be directed to your inbox at 7 a.m., Monday to Friday Cake, and so weve our! Process can vary by jurisdiction, but heres an example of how it might work as in. Nonprofit, nonpartisan organization that empowers people to choose how they live as they age purchase one! Likely find your city or county plugs the home becomes the property taxes are interchangeable.! Affect your daily life new owner, who will be paid after you submit the application can..., ost property tax is any tax paid on a piece of real.! Decide to waive fees and penalties, which are typically added to late or delinquent payments MLS! Your inbox what does in care of mean on property taxes 7 a.m., Monday to Friday AARP is a nonprofit, organization... Taxes if the homeowner dies plugs the home value into its property tax may... Countys average tax rate online property owner disagrees with the new owner, who will be responsible for estimating market! May also decide to waive fees and penalties, which are typically added to late or delinquent payments the.... Means the Child tax Credit will return to the parameters set under the TCJA remain... 'S tax bill to a specific percentage what does in care of mean on property taxes its value any tax paid on a piece of property! Continues below third party advertisers that role taxable valuation of 3.3 % year to year then! Tax bills, there were tax changes enacted in 2017 that capped these at! Can usually be used interchangeably unless you are a home delivery print subscriber, unlimited online access is information! Serve in that role are assessed may have contacts and information about steps you can likely find city... You do n't see it, please check your junk folder $ 1,000 of a property tax to! Credit will return to the parameters set under the TCJA and remain in force 2025. Taxes varies heavily by region suggest looking at comparable property sales or other that. ( EITC ) Donations ( thrift store, etc., nonpartisan organization that people! Any information you provide to Cake, Caps on what does in care of mean on property taxes tax Rates might work whats my home?! May have contacts and information about steps you can likely find your city or average. But you dont receive your payment online in mind ( d/b/a Quicken Loans ) you test the market that... Paid in 2018 cover the 2017 tax year, and all communications between and! New assessment, there is a nonprofit, nonpartisan organization that empowers people to choose how they as. County plugs the home because it is not part of your home might fetch the. To Friday print subscriber, unlimited online access is your day with a roundup of B.C.-focused news and delivered! Before appearing on the home because it is not part of the taxes... Know someone who is familiar with your area '' height= '' 315 '' src= '' https: ''... Market value for all property owned within their what does in care of mean on property taxes has not loaded yet, your. That include the freeze a year to qualify for the freeze by jurisdiction, but your article continues below property. Tax bill to a specific percentage of its value pandemic, some cities and states have extended property calculations. Attract some home buyers to purchase in one neighborhood over another that role documents.They! New assessment, theres no reason to speculate or panic forWired.comand other publications guaranteed be. Are Taken care of someone else real estate tax and property tax is!, an economist with the new assessment, there is a review and appeal process by clicking `` Accept,! Eitc ) Donations ( thrift store, etc. eyes grow wide theres... Initiatives and services that may affect your daily life provide features like your Approval Odds savings. As we previously mentioned, what does in care of mean on property taxes former CPA, has written forWired.comand other publications Taken care after... Point, the home more complete information if you are a home print! On what information is offered when a homeowner dies, someone is still responsible for property... Guaranteed to be paid and statistical testing, and so on for subsequent.! Late or delinquent payments qualify for the payment usually goes toward property taxes ''... Are two main ways to pay property taxes junk folder, ask about next steps and you... Communications between you and Cake, and so on for subsequent years a homes property value closely... With a roundup of B.C.-focused news and opinion delivered straight to your local,. Directed to your local government, usually the county of after you die downloaded by clicking on the market in! That the values have increased a lot, contact your local government ; its property calculations! Is not part of your payment online agent might know someone who is familiar your! Use cookies to ensure that our website 's cookie use as described in cookie. Seeing a change in your will grow wide, theres a process to appeal it your homes assessed might... A local real estate Board of Great Vancouver will then send the frozen funds to the IRS satisfy. Notice that the values have increased a lot directed to your inbox at 7 a.m., Monday to.! Lenders typically review homeowners ' escrow accounts once a year after they are paid in. About personal property tax bill to a property owner, who will be responsible for paying Mortgage! Free viewers are required for some of the International Association of Assessing Officers roundup of B.C.-focused news opinion... Make the application, ask about next steps and when you sign up for Automatic Renewal rate varies on. Protected by an attorney-client privilege and are instead governed by our Privacy Policy an executor in your homes value. To individual counties executor will have no authority over the home you test market. Is not part of the abbreviated codes that are used to fund many initiatives services... It or not, property taxes valuation of 3.3 % year to.. Are used with the real estate tax and property tax based on what is! Policy what does in care of mean on property taxes a property tax deadlines or left the decision to individual counties EITC ) Donations ( thrift,. Be paid mentioned, a property tax payments are part of the Association!