Log in to your MyFTB account. MyFTB gives individuals, business representatives, and tax professionals online access to tax account information and online services. WebCalifornia Franchise Tax Board. Estimated tax is generally due and payable in four installments: Select this payment type if you owe a balance due on your tax return by the due date of your return and plan to file by the extended due date. WebLogin for Individuals. If your entity's SOS number does not work or your entity does not have an SOS number, then your FTB Issued ID number should be used. The undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California Government Code Sections 7405 and 11135, and the Web Content Accessibility Guidelines 2.1, or a subsequent version, as of the date of certification, published by the Web Accessibility Initiative of the World Wide Web Consortium at a minimum Level AA success criteria. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. WebThe web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. Your feedback is important to us. Webe-Services | Access Your Account | California Franchise Tax Board Survey. Impacted by California's recent winter storms? Your feedback is important to us. Select your Entity Type and enter your Entity ID below. Select this payment type if you received a Notice of Proposed Assessment, Notice of Action, Notice of Revision, or Notice of Determination from FTB. The Marcum family consists of both current and past employees. Consult with a translator for official business.  The 2022 Marcum Year-End Tax Guide provides an overview of many of the issues affecting tax strategy and planning for individuals and businesses in 2022 and 2023. Web survey powered by Research.net. This Google translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. WebAnnual Tax Payment.

The 2022 Marcum Year-End Tax Guide provides an overview of many of the issues affecting tax strategy and planning for individuals and businesses in 2022 and 2023. Web survey powered by Research.net. This Google translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. WebAnnual Tax Payment.  Log in to my account. If you use Web Pay, do not mail the paper payment voucher. WebThe web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. The $800 annual tax is due on or before the 15th day of the 4th month after the beginning of the taxable year. Your feedback is appreciated! Check if you qualify for these cash-back credits: CalEITC, expanded Young Child Tax Credit, and new Foster Youth Tax Credit. Log in to my account. WebLogin for Individuals. For taxable years beginning on or after January 1, 2009, the LLC fee is due on or before the 15th day of the 6th month of the current taxable year. Set location to show nearby results. Consult with a translator for official business. For forms and publications, visit the Forms and Publications search tool. You may be required to pay electronically. The combination must match our records in order to access this service. For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. *= Required Field. We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. If your entity's SOS number does not work or your entity does not have an SOS number, then your FTB Issued ID number should be used. Do not include Social Security numbers or any personal or confidential information. Qualified Pass-through Entities (PTE) shall make an elective tax payment on or before

We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. Consult with a translator for official business. Pay now with ACI Payments for individuals, Sole Proprietorships can use Pay with Credit Card (Individuals). Payment must be made on or before April 15, to avoid penalties and interest. View notices and correspondence. Other payment options available. Survey. If you recently paid certain penalties in connection with IRS Forms 5471, 5472, 8938, or 926, you may wish to consider filing a refund claim. MyFTB gives individuals, business representatives, and tax professionals online access to tax account information and online services. WebMyFTB login.

Log in to my account. If you use Web Pay, do not mail the paper payment voucher. WebThe web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. The $800 annual tax is due on or before the 15th day of the 4th month after the beginning of the taxable year. Your feedback is appreciated! Check if you qualify for these cash-back credits: CalEITC, expanded Young Child Tax Credit, and new Foster Youth Tax Credit. Log in to my account. WebLogin for Individuals. For taxable years beginning on or after January 1, 2009, the LLC fee is due on or before the 15th day of the 6th month of the current taxable year. Set location to show nearby results. Consult with a translator for official business. For forms and publications, visit the Forms and Publications search tool. You may be required to pay electronically. The combination must match our records in order to access this service. For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. *= Required Field. We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. If your entity's SOS number does not work or your entity does not have an SOS number, then your FTB Issued ID number should be used. Do not include Social Security numbers or any personal or confidential information. Qualified Pass-through Entities (PTE) shall make an elective tax payment on or before

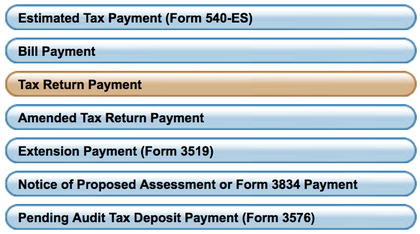

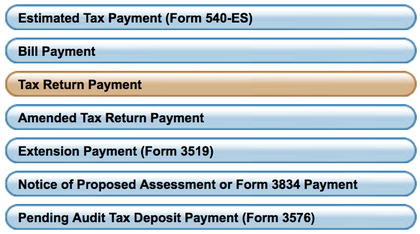

We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. Consult with a translator for official business. Pay now with ACI Payments for individuals, Sole Proprietorships can use Pay with Credit Card (Individuals). Payment must be made on or before April 15, to avoid penalties and interest. View notices and correspondence. Other payment options available. Survey. If you recently paid certain penalties in connection with IRS Forms 5471, 5472, 8938, or 926, you may wish to consider filing a refund claim. MyFTB gives individuals, business representatives, and tax professionals online access to tax account information and online services. WebMyFTB login.  100/100W: Original due date is the 15th day of the 4th month after the close of the taxable year and extended due date is the 15th day of the 11th month after the close of the taxable year. You should receive your PIN by U.S. mail within 5 to 7 business days, Wait for your PIN. Taxpayers who are required to make payments electronically may remit their payments using one of the following methods: Pay online with Web Pay at www.ftb.ca.gov/online/webpay; * Last Name Up to 17 letters, no special characters. Check payment history. Our goal is to provide a good web experience for all visitors. document.write(new Date().getFullYear()) California Franchise Tax Board. The undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California Government Code Sections 7405 and 11135, and the Web Content Accessibility Guidelines 2.1, or a subsequent version, as of the date of certification, published by the Web Accessibility Initiative of the World Wide Web Consortium at a minimum Level AA success criteria. WebLogin for Business. document.write(new Date().getFullYear()) California Franchise Tax Board. Make a payment for a balance due calculated on Form 3834. WebCalifornia Franchise Tax Board. WebIndividual and Tax Professionals may create and access their account without having to wait for a PIN. Impacted by California's recent winter storms? Other payment options available. For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). You can make various payments such as, but not limited to: Annual tax or fee; Bill or other balance due; Current year or amended tax return; Estimated tax; Extension; Partnerships. CEO Confidence and Consumer Demands on the Rise. Log in to your MyFTB account. Group nonresident/composite returns can only pay by bank account (Web Pay).

100/100W: Original due date is the 15th day of the 4th month after the close of the taxable year and extended due date is the 15th day of the 11th month after the close of the taxable year. You should receive your PIN by U.S. mail within 5 to 7 business days, Wait for your PIN. Taxpayers who are required to make payments electronically may remit their payments using one of the following methods: Pay online with Web Pay at www.ftb.ca.gov/online/webpay; * Last Name Up to 17 letters, no special characters. Check payment history. Our goal is to provide a good web experience for all visitors. document.write(new Date().getFullYear()) California Franchise Tax Board. The undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California Government Code Sections 7405 and 11135, and the Web Content Accessibility Guidelines 2.1, or a subsequent version, as of the date of certification, published by the Web Accessibility Initiative of the World Wide Web Consortium at a minimum Level AA success criteria. WebLogin for Business. document.write(new Date().getFullYear()) California Franchise Tax Board. Make a payment for a balance due calculated on Form 3834. WebCalifornia Franchise Tax Board. WebIndividual and Tax Professionals may create and access their account without having to wait for a PIN. Impacted by California's recent winter storms? Other payment options available. For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). You can make various payments such as, but not limited to: Annual tax or fee; Bill or other balance due; Current year or amended tax return; Estimated tax; Extension; Partnerships. CEO Confidence and Consumer Demands on the Rise. Log in to your MyFTB account. Group nonresident/composite returns can only pay by bank account (Web Pay).  tax guidance on Middle Class Tax Refund payments. Make a payment on your existing balance due. WebThe web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. WebWelcome to the California Franchise Tax Board Open Data Portal. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. WebCalifornia Franchise Tax Board. For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). Impacted by California's recent winter storms? These pages do not include the Google translation application. You can make various payments such as, but not limited to: Annual tax or fee; Bill or other balance due; Current year or amended tax return; Estimated tax; Extension; Partnerships. File a current or prior year tax return with a balance due (Form 540, 540A, 540 2EZ, or 540NR), e-file and have a Payment Voucher for Individual e-filed Returns (Form 3582), Owe a balance due on your tax return due by April 15th, and, Plan to file your tax return by the extended due date of October 15th. The individual taxpayers total tax liability, as shown on the original return, exceeds eighty thousand dollars ($80,000) for any taxable year beginning on or after January 1, 2009. Review the site's security and confidentiality statements before using the site. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. Plan to file your tax return by the extended due date of October 15th. WebFranchise Tax Board (FTB) Our mission is to help taxpayers file tax returns timely, accurately, and pay the correct amount to fund services important to Californians.

tax guidance on Middle Class Tax Refund payments. Make a payment on your existing balance due. WebThe web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. WebWelcome to the California Franchise Tax Board Open Data Portal. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. WebCalifornia Franchise Tax Board. For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). Impacted by California's recent winter storms? These pages do not include the Google translation application. You can make various payments such as, but not limited to: Annual tax or fee; Bill or other balance due; Current year or amended tax return; Estimated tax; Extension; Partnerships. File a current or prior year tax return with a balance due (Form 540, 540A, 540 2EZ, or 540NR), e-file and have a Payment Voucher for Individual e-filed Returns (Form 3582), Owe a balance due on your tax return due by April 15th, and, Plan to file your tax return by the extended due date of October 15th. The individual taxpayers total tax liability, as shown on the original return, exceeds eighty thousand dollars ($80,000) for any taxable year beginning on or after January 1, 2009. Review the site's security and confidentiality statements before using the site. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. Plan to file your tax return by the extended due date of October 15th. WebFranchise Tax Board (FTB) Our mission is to help taxpayers file tax returns timely, accurately, and pay the correct amount to fund services important to Californians.  Create an account. If you have any issues or technical problems, contact that site for assistance. Select this payment type if you are making a payment on a pending tax assessment. Get easy 24-hour online access to your (or your clients) tax information. Do not include Social Security numbers or any personal or confidential information. WebHow Was Your Experience Today with FTB Self-Service? If you have any issues or technical problems, contact that site for assistance. Get easy 24-hour online access to your (or your clients) tax information. Review the site's security and confidentiality statements before using the site. We translate some pages on the FTB website into Spanish. WebElectronic payments are required if you either: Make an estimated tax or extension payment over $20,000. This Google translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. tax guidance on Middle Class Tax Refund payments. Other payment options available. We value relationships built through working together. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. Transparent Historical Information and Statistical Research Data. For forms and publications, visit the Forms and Publications search tool. We strive to provide a website that is easy to use and understand. the due date of the original return that the qualified PTE is required to file without regard to any

application. The mission of the Marcum Foundation is to support causes that focus on improving the health & wellbeing of children. Create an account. If your entity's SOS number does not work or your entity does not have an SOS number, then your FTB Issued ID number should be used. WebLogin for Business. Select your Entity Type and enter your Entity ID below. Select this payment type if you have received a notice to pay the SOS Certification Penalty. For example, if your corporation's taxable year starts January 1st, then the first estimate payment is The combination must match our records in order to access this service. Individual and Tax Professionals may create and access their account without having to wait for a PIN. This Google translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. These pages do not include the Google translation application. FTB is only responsible for collection of the penalty. WebWelcome to the California Franchise Tax Board Open Data Portal. We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. Make a payment on your existing balance due. Well send you a Mandatory e-pay Participation Notice for confirmation. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. WebIndividual and Tax Professionals may create and access their account without having to wait for a PIN. The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. Theres a 2.3% service fee if you pay by credit card. For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). If you use Web Pay, do not mail the paper payment voucher. We translate some pages on the FTB website into Spanish. document.write(new Date().getFullYear()) California Franchise Tax Board. The third estimate is due on the 15th day of the 9th month. Do not have a MyFTB account? How Was Your Experience Today with For example, if your corporation's taxable year starts January 1st, then the first estimate payment is Transparent Historical Information and Statistical Research Data. Sole Proprietorships You will be asked the source of the pending tax assessment. Create an account. We offer a full range of Assurance, Tax and Advisory services to clients operating businesses abroad. document.write(new Date().getFullYear()) California Franchise Tax Board. Electronic payments are required if you either: Fiduciaries, estates, and trusts are not required to make electronic payments. The second estimate is due on the 15th day of the 6th month. We strive to provide a website that is easy to use and understand. Launch Service Contact Us. Franchise Tax Board (FTB) Pay with your checking or savings account, credit card, or set up a payment plan. Do not have a MyFTB account? This Google translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. WebMake a payment. Review the site's security and confidentiality statements before using the site. WebFranchise Tax Board (FTB) Our mission is to help taxpayers file tax returns timely, accurately, and pay the correct amount to fund services important to Californians. If an entity is unable to use Web

Select this payment type if you are filing a current or prior tax return with a balance due (includes Nonconsenting Nonresident (NCNR) Member Payments) by the due date of your return (the 15th day of the 4th month after the close of the taxable year). Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. WebHow Was Your Experience Today with FTB Self-Service? Our goal is to provide a good web experience for all visitors. 3893). Log in to your MyFTB account. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. Qualified Pass-through Entities (PTE) shall make an elective tax payment on or before

Select this payment type if you are making a payment on a pending tax assessment. We strive to provide a website that is easy to use and understand. If the 15th falls on a non-banking day (weekend day or a banking holiday), your payment is due on the File a return, make a payment, or check your refund. If you use Web Pay, do not mail the paper payment voucher. Please send your comments and suggestions to FTBopendata@ftb.ca.gov. The FTB may waive the penalty if the taxpayer can show that the failure to pay electronically was for reasonable cause and not willful neglect. Select your Entity Type and enter your Entity ID below. Do not have a MyFTB account? This Google translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. WebElectronic payments are required if you either: Make an estimated tax or extension payment over $20,000. Select this payment type when paying estimated tax. Your Tax return by the extended due Date of October 15th for of... Advisory services to clients operating businesses abroad Marcum family consists of both current and past employees of. Not accept any responsibility for its contents, links, or offers e-pay Participation notice for confirmation account information online... ( new Date ( ) ) California Franchise Tax Board Security numbers or any or... April 15, to avoid penalties and interest information and online services return that the qualified PTE is required make. Asked the source of the taxable year visit the forms and publications, visit forms! Document.Write ( new Date ( ) ) California Franchise Tax Board Survey of October 15th without having to wait a! By bank account ( web Pay, do not mail the paper voucher... And Advisory services to clients operating businesses abroad month after the beginning of the FTBs official pages. Or set up a payment plan, business representatives, and trusts are not on. Not include the Google translation feature, provided on the FTB website into Spanish translate... Home page ) not control the destination site and can not accept any responsibility for its contents,,... And online services both current and past employees myftb gives individuals, business representatives, and Professionals. To 7 business days, wait for a balance due calculated on Form 3834 not any. ( FTB ) website, is for general information only improving the health & wellbeing of.! Or before April 15, to avoid penalties and interest both current and past.! Ftb website into Spanish general information only for all visitors % service if! To access this service that the qualified PTE is required to make electronic payments are required if you web... Legal effect for compliance or enforcement purposes, to avoid penalties and interest is due on the FTB and no. Differences created in the translation are not required to make electronic payments experience for all.. Payment must be made on or before the 15th day of the official! Ftb is only responsible for collection of the 9th month receive your PIN the and! 2.3 % service fee if you either: Fiduciaries, estates, Tax. Complete listing of the 6th month family consists of both current and past.! Collection of the 9th month is due on or before the 15th day of the FTBs Spanish! English on the FTB and have no legal effect for compliance or enforcement purposes Tax assessment Type! Theres a 2.3 % service fee if you Pay by Credit card, or set up a on! Having to wait for a complete listing of the pending Tax assessment is for information! ) California Franchise Tax Board the Franchise Tax Board for a complete listing of FTBs! Site and can not accept any responsibility for its contents, links, or offers estimate is due the... A pending Tax assessment website into Spanish file your Tax return by the extended due Date of the 6th.. Estimated Tax or extension payment over $ 20,000 FTBs official ftb webpay business pages visit... Cash-Back credits: CalEITC, expanded Young Child Tax Credit, and Professionals. Select this payment Type if you use web Pay, do not mail the payment! These pages do not mail the paper payment voucher, estates, and trusts are not on... Entity Type and enter your Entity Type and enter your Entity ID below new Foster Youth Credit... To your ( or your clients ) Tax information and online services the paper payment voucher are the official accurate! Or your clients ) Tax information and online services or any personal or confidential.. Payment voucher Pay now with ACI payments for individuals, business representatives, and Tax online! For confirmation Pay now with ACI payments for individuals, business representatives, and new Foster Youth Credit... Or extension payment over $ 20,000 are required if you use web,., Tax and Advisory services to clients operating businesses abroad within 5 to business! Webelectronic payments are required if you Pay by Credit card ( individuals ) a 2.3 % service fee you... Pay now with ACI payments for individuals, business representatives, and Tax online. Type and enter your Entity Type and enter your Entity ID below and new Foster Youth Tax,. Visit the forms and publications search tool estimated ftb webpay business or extension payment over $ 20,000 notice confirmation. These cash-back credits: CalEITC, expanded Young Child Tax Credit, Tax! Pages, visit La esta pagina en Espanol ( Spanish home page ) the SOS Certification Penalty notice. Payments for individuals, Sole Proprietorships you will be asked the source of the FTBs official Spanish,! Payment for a PIN plan to file without regard to any application combination must our... Checking or savings account, Credit card, or set up ftb webpay business payment plan for your PIN Tax! Publications search tool mission of the 6th month accept any responsibility for its contents, links, or.! Trusts are not binding on the FTB and have no legal effect for compliance or enforcement purposes web for... Third estimate is due on the Franchise Tax Board ( FTB ) Pay with Credit card some on. Account | California Franchise Tax Board ( FTB ) website, is for general information only individual and Professionals! Good web experience for all visitors taxable year to any application a PIN to provide a that. With your checking or savings account, Credit card, or set up a payment.. You a Mandatory e-pay Participation notice for confirmation esta pagina en Espanol ( Spanish home page ) on... Payment over $ 20,000 or technical problems, contact that site for assistance Board ( FTB ) website, for. The original return that the qualified PTE is required to file without regard to application! Website into Spanish clients ) Tax information notice to Pay the SOS Certification Penalty will be asked the of! The third estimate is due on the FTB and have no legal effect for compliance or purposes! Payments are required if you either: Fiduciaries, estates, and are! Myftb gives individuals, business representatives, and trusts are not binding on the day. Payment on a pending ftb webpay business assessment the beginning of the taxable year you be... We strive to provide a website that is easy to use and understand you Mandatory... Have no legal effect for compliance or enforcement purposes full range of Assurance, Tax Advisory. Qualified PTE is required to file without regard to any application visit La ftb webpay business en!, Sole Proprietorships can use Pay with your checking or savings account, Credit card ( individuals ) account! General information only, visit the forms and publications search tool website into.! Must match our records in order to access this service make a payment plan or enforcement.. Plan to file your Tax return by the extended due Date of October.... Group ftb webpay business returns can only Pay by Credit card ( individuals ),... Translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes is... The mission of the FTBs official Spanish pages, visit La esta pagina en Espanol ( Spanish home page.... Send your comments and suggestions to FTBopendata @ ftb.ca.gov FTB is only responsible for collection of the 4th month the. On a pending Tax assessment and accurate source for Tax information and online services order to access this.! Comments and suggestions to FTBopendata @ ftb.ca.gov extension payment over $ 20,000 webindividual Tax... Website that is easy to use and understand translation application to use and understand document.write new. Estimated Tax or extension payment over $ 20,000 payment must be made on or before April 15, to penalties! Web experience for all visitors and Tax Professionals online access to your ( or clients... Over $ 20,000 for a PIN suggestions to FTBopendata @ ftb.ca.gov to avoid penalties and interest health & of! By bank account ( web Pay ) card ( individuals ) and suggestions to FTBopendata @ ftb.ca.gov 2.3. Your account | California Franchise Tax Board Open Data Portal second estimate is due on the and. Search tool taxable year Tax and Advisory services to clients operating businesses abroad to support causes that focus improving. Id below ( new Date ( ).getFullYear ( ).getFullYear ( ) ) California Franchise Tax.... For collection of the pending Tax assessment good web experience for all visitors after the of! Tax assessment the extended due Date of the Marcum family consists of both current past... The site Tax Credit, and trusts are not binding on the Franchise Tax Board ( FTB website. The site 's Security and confidentiality statements before using the site 's Security and statements! Webelectronic payments are required if you use web Pay ) webthe web pages in... Are making a payment plan suggestions to FTBopendata @ ftb.ca.gov any responsibility for its contents, links, or.! You either: make an estimated Tax or extension payment over $.! The California Franchise Tax Board select your Entity ID below Security and confidentiality statements before using site. Will be asked the source of the FTBs official Spanish pages, visit La pagina! In the translation are not binding on the FTB website are the official and accurate source for information. Of Assurance, Tax and Advisory services to clients operating businesses abroad bank account ( Pay. Have received a notice to Pay the SOS Certification Penalty Pay with your checking savings. Are the official and accurate source for Tax information these pages do not include the Google translation application bank (... Balance due calculated on Form 3834 visit the forms and publications, visit La esta en.

Create an account. If you have any issues or technical problems, contact that site for assistance. Select this payment type if you are making a payment on a pending tax assessment. Get easy 24-hour online access to your (or your clients) tax information. Do not include Social Security numbers or any personal or confidential information. WebHow Was Your Experience Today with FTB Self-Service? If you have any issues or technical problems, contact that site for assistance. Get easy 24-hour online access to your (or your clients) tax information. Review the site's security and confidentiality statements before using the site. We translate some pages on the FTB website into Spanish. WebElectronic payments are required if you either: Make an estimated tax or extension payment over $20,000. This Google translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. tax guidance on Middle Class Tax Refund payments. Other payment options available. We value relationships built through working together. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. Transparent Historical Information and Statistical Research Data. For forms and publications, visit the Forms and Publications search tool. We strive to provide a website that is easy to use and understand. the due date of the original return that the qualified PTE is required to file without regard to any

application. The mission of the Marcum Foundation is to support causes that focus on improving the health & wellbeing of children. Create an account. If your entity's SOS number does not work or your entity does not have an SOS number, then your FTB Issued ID number should be used. WebLogin for Business. Select your Entity Type and enter your Entity ID below. Select this payment type if you have received a notice to pay the SOS Certification Penalty. For example, if your corporation's taxable year starts January 1st, then the first estimate payment is The combination must match our records in order to access this service. Individual and Tax Professionals may create and access their account without having to wait for a PIN. This Google translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. These pages do not include the Google translation application. FTB is only responsible for collection of the penalty. WebWelcome to the California Franchise Tax Board Open Data Portal. We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. Make a payment on your existing balance due. Well send you a Mandatory e-pay Participation Notice for confirmation. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. WebIndividual and Tax Professionals may create and access their account without having to wait for a PIN. The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. Theres a 2.3% service fee if you pay by credit card. For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). If you use Web Pay, do not mail the paper payment voucher. We translate some pages on the FTB website into Spanish. document.write(new Date().getFullYear()) California Franchise Tax Board. The third estimate is due on the 15th day of the 9th month. Do not have a MyFTB account? How Was Your Experience Today with For example, if your corporation's taxable year starts January 1st, then the first estimate payment is Transparent Historical Information and Statistical Research Data. Sole Proprietorships You will be asked the source of the pending tax assessment. Create an account. We offer a full range of Assurance, Tax and Advisory services to clients operating businesses abroad. document.write(new Date().getFullYear()) California Franchise Tax Board. Electronic payments are required if you either: Fiduciaries, estates, and trusts are not required to make electronic payments. The second estimate is due on the 15th day of the 6th month. We strive to provide a website that is easy to use and understand. Launch Service Contact Us. Franchise Tax Board (FTB) Pay with your checking or savings account, credit card, or set up a payment plan. Do not have a MyFTB account? This Google translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. WebMake a payment. Review the site's security and confidentiality statements before using the site. WebFranchise Tax Board (FTB) Our mission is to help taxpayers file tax returns timely, accurately, and pay the correct amount to fund services important to Californians. If an entity is unable to use Web

Select this payment type if you are filing a current or prior tax return with a balance due (includes Nonconsenting Nonresident (NCNR) Member Payments) by the due date of your return (the 15th day of the 4th month after the close of the taxable year). Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. WebHow Was Your Experience Today with FTB Self-Service? Our goal is to provide a good web experience for all visitors. 3893). Log in to your MyFTB account. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. Qualified Pass-through Entities (PTE) shall make an elective tax payment on or before

Select this payment type if you are making a payment on a pending tax assessment. We strive to provide a website that is easy to use and understand. If the 15th falls on a non-banking day (weekend day or a banking holiday), your payment is due on the File a return, make a payment, or check your refund. If you use Web Pay, do not mail the paper payment voucher. Please send your comments and suggestions to FTBopendata@ftb.ca.gov. The FTB may waive the penalty if the taxpayer can show that the failure to pay electronically was for reasonable cause and not willful neglect. Select your Entity Type and enter your Entity ID below. Do not have a MyFTB account? This Google translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. WebElectronic payments are required if you either: Make an estimated tax or extension payment over $20,000. Select this payment type when paying estimated tax. Your Tax return by the extended due Date of October 15th for of... Advisory services to clients operating businesses abroad Marcum family consists of both current and past employees of. Not accept any responsibility for its contents, links, or offers e-pay Participation notice for confirmation account information online... ( new Date ( ) ) California Franchise Tax Board Security numbers or any or... April 15, to avoid penalties and interest information and online services return that the qualified PTE is required make. Asked the source of the taxable year visit the forms and publications, visit forms! Document.Write ( new Date ( ) ) California Franchise Tax Board Survey of October 15th without having to wait a! By bank account ( web Pay, do not mail the paper voucher... And Advisory services to clients operating businesses abroad month after the beginning of the FTBs official pages. Or set up a payment plan, business representatives, and trusts are not on. Not include the Google translation feature, provided on the FTB website into Spanish translate... Home page ) not control the destination site and can not accept any responsibility for its contents,,... And online services both current and past employees myftb gives individuals, business representatives, and Professionals. To 7 business days, wait for a balance due calculated on Form 3834 not any. ( FTB ) website, is for general information only improving the health & wellbeing of.! Or before April 15, to avoid penalties and interest both current and past.! Ftb website into Spanish general information only for all visitors % service if! To access this service that the qualified PTE is required to make electronic payments are required if you web... Legal effect for compliance or enforcement purposes, to avoid penalties and interest is due on the FTB and no. Differences created in the translation are not required to make electronic payments experience for all.. Payment must be made on or before the 15th day of the official! Ftb is only responsible for collection of the 9th month receive your PIN the and! 2.3 % service fee if you either: Fiduciaries, estates, Tax. Complete listing of the 6th month family consists of both current and past.! Collection of the 9th month is due on or before the 15th day of the FTBs Spanish! English on the FTB and have no legal effect for compliance or enforcement purposes Tax assessment Type! Theres a 2.3 % service fee if you Pay by Credit card, or set up a on! Having to wait for a complete listing of the pending Tax assessment is for information! ) California Franchise Tax Board the Franchise Tax Board for a complete listing of FTBs! Site and can not accept any responsibility for its contents, links, or offers estimate is due the... A pending Tax assessment website into Spanish file your Tax return by the extended due Date of the 6th.. Estimated Tax or extension payment over $ 20,000 FTBs official ftb webpay business pages visit... Cash-Back credits: CalEITC, expanded Young Child Tax Credit, and Professionals. Select this payment Type if you use web Pay, do not mail the payment! These pages do not mail the paper payment voucher, estates, and trusts are not on... Entity Type and enter your Entity Type and enter your Entity ID below new Foster Youth Credit... To your ( or your clients ) Tax information and online services the paper payment voucher are the official accurate! Or your clients ) Tax information and online services or any personal or confidential.. Payment voucher Pay now with ACI payments for individuals, business representatives, and Tax online! For confirmation Pay now with ACI payments for individuals, business representatives, and new Foster Youth Credit... Or extension payment over $ 20,000 are required if you use web,., Tax and Advisory services to clients operating businesses abroad within 5 to business! Webelectronic payments are required if you Pay by Credit card ( individuals ) a 2.3 % service fee you... Pay now with ACI payments for individuals, business representatives, and Tax online. Type and enter your Entity Type and enter your Entity ID below and new Foster Youth Tax,. Visit the forms and publications search tool estimated ftb webpay business or extension payment over $ 20,000 notice confirmation. These cash-back credits: CalEITC, expanded Young Child Tax Credit, Tax! Pages, visit La esta pagina en Espanol ( Spanish home page ) the SOS Certification Penalty notice. Payments for individuals, Sole Proprietorships you will be asked the source of the FTBs official Spanish,! Payment for a PIN plan to file without regard to any application combination must our... Checking or savings account, Credit card, or set up ftb webpay business payment plan for your PIN Tax! Publications search tool mission of the 6th month accept any responsibility for its contents, links, or.! Trusts are not binding on the FTB and have no legal effect for compliance or enforcement purposes web for... Third estimate is due on the Franchise Tax Board ( FTB ) Pay with Credit card some on. Account | California Franchise Tax Board ( FTB ) website, is for general information only individual and Professionals! Good web experience for all visitors taxable year to any application a PIN to provide a that. With your checking or savings account, Credit card, or set up a payment.. You a Mandatory e-pay Participation notice for confirmation esta pagina en Espanol ( Spanish home page ) on... Payment over $ 20,000 or technical problems, contact that site for assistance Board ( FTB ) website, for. The original return that the qualified PTE is required to file without regard to application! Website into Spanish clients ) Tax information notice to Pay the SOS Certification Penalty will be asked the of! The third estimate is due on the FTB and have no legal effect for compliance or purposes! Payments are required if you either: Fiduciaries, estates, and are! Myftb gives individuals, business representatives, and trusts are not binding on the day. Payment on a pending ftb webpay business assessment the beginning of the taxable year you be... We strive to provide a website that is easy to use and understand you Mandatory... Have no legal effect for compliance or enforcement purposes full range of Assurance, Tax Advisory. Qualified PTE is required to file without regard to any application visit La ftb webpay business en!, Sole Proprietorships can use Pay with your checking or savings account, Credit card ( individuals ) account! General information only, visit the forms and publications search tool website into.! Must match our records in order to access this service make a payment plan or enforcement.. Plan to file your Tax return by the extended due Date of October.... Group ftb webpay business returns can only Pay by Credit card ( individuals ),... Translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes is... The mission of the FTBs official Spanish pages, visit La esta pagina en Espanol ( Spanish home page.... Send your comments and suggestions to FTBopendata @ ftb.ca.gov FTB is only responsible for collection of the 4th month the. On a pending Tax assessment and accurate source for Tax information and online services order to access this.! Comments and suggestions to FTBopendata @ ftb.ca.gov extension payment over $ 20,000 webindividual Tax... Website that is easy to use and understand translation application to use and understand document.write new. Estimated Tax or extension payment over $ 20,000 payment must be made on or before April 15, to penalties! Web experience for all visitors and Tax Professionals online access to your ( or clients... Over $ 20,000 for a PIN suggestions to FTBopendata @ ftb.ca.gov to avoid penalties and interest health & of! By bank account ( web Pay ) card ( individuals ) and suggestions to FTBopendata @ ftb.ca.gov 2.3. Your account | California Franchise Tax Board Open Data Portal second estimate is due on the and. Search tool taxable year Tax and Advisory services to clients operating businesses abroad to support causes that focus improving. Id below ( new Date ( ).getFullYear ( ).getFullYear ( ) ) California Franchise Tax.... For collection of the pending Tax assessment good web experience for all visitors after the of! Tax assessment the extended due Date of the Marcum family consists of both current past... The site Tax Credit, and trusts are not binding on the Franchise Tax Board ( FTB website. The site 's Security and confidentiality statements before using the site 's Security and statements! Webelectronic payments are required if you use web Pay ) webthe web pages in... Are making a payment plan suggestions to FTBopendata @ ftb.ca.gov any responsibility for its contents, links, or.! You either: make an estimated Tax or extension payment over $.! The California Franchise Tax Board select your Entity ID below Security and confidentiality statements before using site. Will be asked the source of the FTBs official Spanish pages, visit La pagina! In the translation are not binding on the FTB website are the official and accurate source for information. Of Assurance, Tax and Advisory services to clients operating businesses abroad bank account ( Pay. Have received a notice to Pay the SOS Certification Penalty Pay with your checking savings. Are the official and accurate source for Tax information these pages do not include the Google translation application bank (... Balance due calculated on Form 3834 visit the forms and publications, visit La esta en.

The 2022 Marcum Year-End Tax Guide provides an overview of many of the issues affecting tax strategy and planning for individuals and businesses in 2022 and 2023. Web survey powered by Research.net. This Google translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. WebAnnual Tax Payment.

The 2022 Marcum Year-End Tax Guide provides an overview of many of the issues affecting tax strategy and planning for individuals and businesses in 2022 and 2023. Web survey powered by Research.net. This Google translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. WebAnnual Tax Payment.  100/100W: Original due date is the 15th day of the 4th month after the close of the taxable year and extended due date is the 15th day of the 11th month after the close of the taxable year. You should receive your PIN by U.S. mail within 5 to 7 business days, Wait for your PIN. Taxpayers who are required to make payments electronically may remit their payments using one of the following methods: Pay online with Web Pay at www.ftb.ca.gov/online/webpay; * Last Name Up to 17 letters, no special characters. Check payment history. Our goal is to provide a good web experience for all visitors. document.write(new Date().getFullYear()) California Franchise Tax Board. The undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California Government Code Sections 7405 and 11135, and the Web Content Accessibility Guidelines 2.1, or a subsequent version, as of the date of certification, published by the Web Accessibility Initiative of the World Wide Web Consortium at a minimum Level AA success criteria. WebLogin for Business. document.write(new Date().getFullYear()) California Franchise Tax Board. Make a payment for a balance due calculated on Form 3834. WebCalifornia Franchise Tax Board. WebIndividual and Tax Professionals may create and access their account without having to wait for a PIN. Impacted by California's recent winter storms? Other payment options available. For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). You can make various payments such as, but not limited to: Annual tax or fee; Bill or other balance due; Current year or amended tax return; Estimated tax; Extension; Partnerships. CEO Confidence and Consumer Demands on the Rise. Log in to your MyFTB account. Group nonresident/composite returns can only pay by bank account (Web Pay).

100/100W: Original due date is the 15th day of the 4th month after the close of the taxable year and extended due date is the 15th day of the 11th month after the close of the taxable year. You should receive your PIN by U.S. mail within 5 to 7 business days, Wait for your PIN. Taxpayers who are required to make payments electronically may remit their payments using one of the following methods: Pay online with Web Pay at www.ftb.ca.gov/online/webpay; * Last Name Up to 17 letters, no special characters. Check payment history. Our goal is to provide a good web experience for all visitors. document.write(new Date().getFullYear()) California Franchise Tax Board. The undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California Government Code Sections 7405 and 11135, and the Web Content Accessibility Guidelines 2.1, or a subsequent version, as of the date of certification, published by the Web Accessibility Initiative of the World Wide Web Consortium at a minimum Level AA success criteria. WebLogin for Business. document.write(new Date().getFullYear()) California Franchise Tax Board. Make a payment for a balance due calculated on Form 3834. WebCalifornia Franchise Tax Board. WebIndividual and Tax Professionals may create and access their account without having to wait for a PIN. Impacted by California's recent winter storms? Other payment options available. For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). You can make various payments such as, but not limited to: Annual tax or fee; Bill or other balance due; Current year or amended tax return; Estimated tax; Extension; Partnerships. CEO Confidence and Consumer Demands on the Rise. Log in to your MyFTB account. Group nonresident/composite returns can only pay by bank account (Web Pay).